- World Population Review Newsletter

- Posts

- Can a Single Export Sink a Whole Country?

Can a Single Export Sink a Whole Country?

Tracking the fragile economies built on oil, cocoa, lithium, and more.

Greetings, discerning mind of global foresight!

Imagine steering your retirement plans, investment strategy, or next big move based on a country’s economic pulse—only to discover it rests on a single commodity. What happens when that one lifeline falters?

In this edition, we uncover the hidden fragility of national economies tethered to a single export. Whether it's cocoa in Ghana or lithium in Chile, the dependency poses both profound risk and intriguing opportunity.

Let’s explore the world’s most export-dependent economies—and what their stories mean for your future.

The AI Race Just Went Nuclear — Own the Rails.

Meta, Google, and Microsoft just reported record profits — and record AI infrastructure spending:

Meta boosted its AI budget to as much as $72 billion this year.

Google raised its estimate to $93 billion for 2025.

Microsoft is following suit, investing heavily in AI data centers and decision layers.

While Wall Street reacts, the message is clear: AI infrastructure is the next trillion-dollar frontier.

RAD Intel already builds that infrastructure — the AI decision layer powering marketing performance for Fortune 1000 brands. Backed by Adobe, Fidelity Ventures, and insiders from Google, Meta, and Amazon, the company has raised $50M+, grown valuation 4,900%, and doubled sales contracts in 2025 with seven-figure contracts secured.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

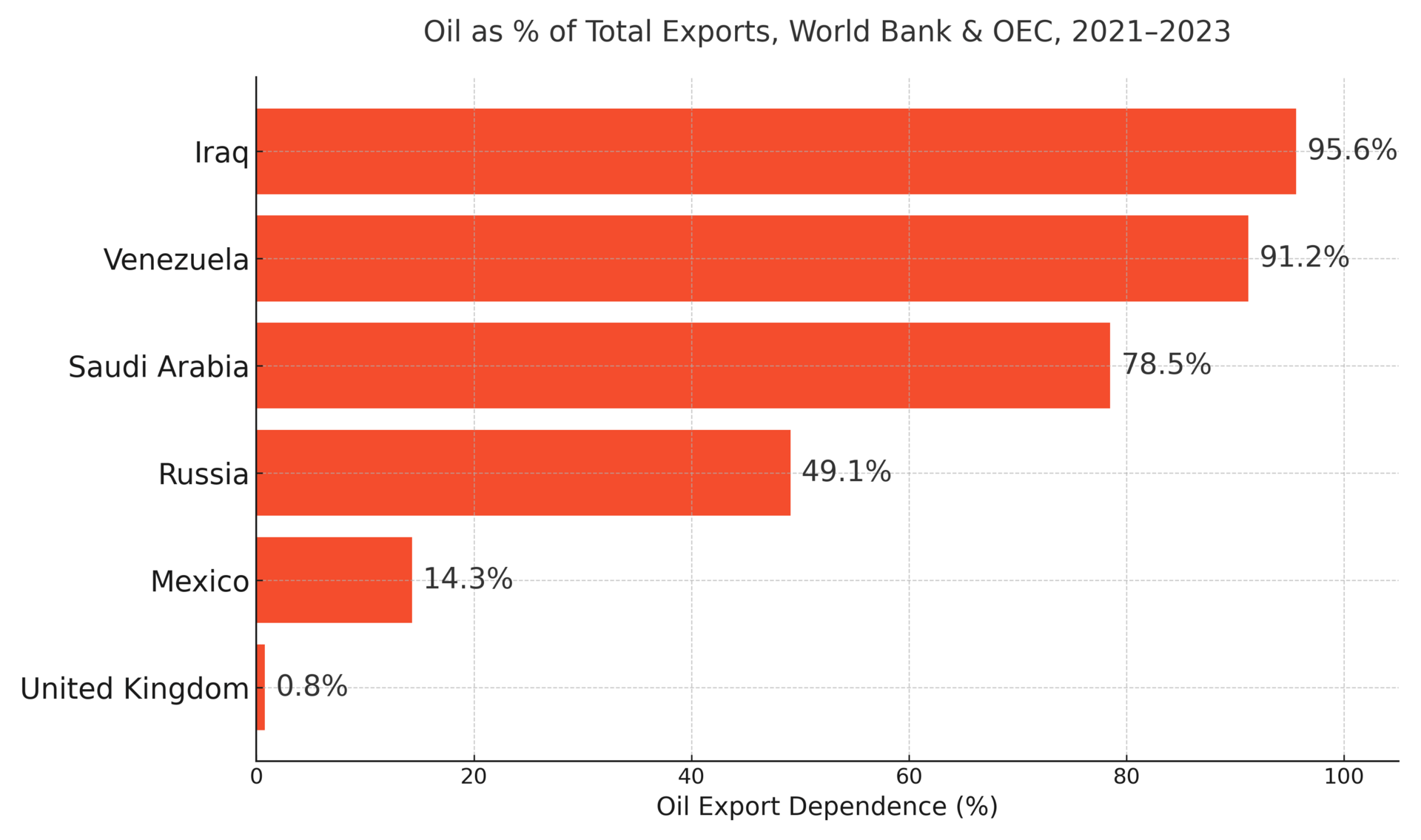

For Venezuela, oil has long been both a blessing and a trap. The country boasts the largest proven oil reserves on Earth, yet over 90% of its exports come from crude. When oil prices plummet—as they did in 2014—the economy doesn't just slow down. It implodes.

The aftermath? Hyperinflation, mass migration, and a humanitarian crisis. While recent stabilization efforts show faint promise, Venezuela’s economic engine remains tightly bound to a volatile global oil market.

Hard truth: In 2020, Venezuela’s oil output hit a 77-year low, despite holding the world’s largest reserves.

Ghana is the world’s second-largest cocoa exporter, and the bean accounts for roughly 30% of its export income. But cocoa prices are dictated by factors well outside Ghana’s control: global demand, climate, and pests.

Recent years saw price booms, but also weather shocks and farmer protests. Though the country is diversifying with oil and gold, cocoa remains deeply entrenched in its economic DNA.

Curious stat: Ghana grows 20% of the world’s cocoa, yet most farmers earn less than $1 a day.

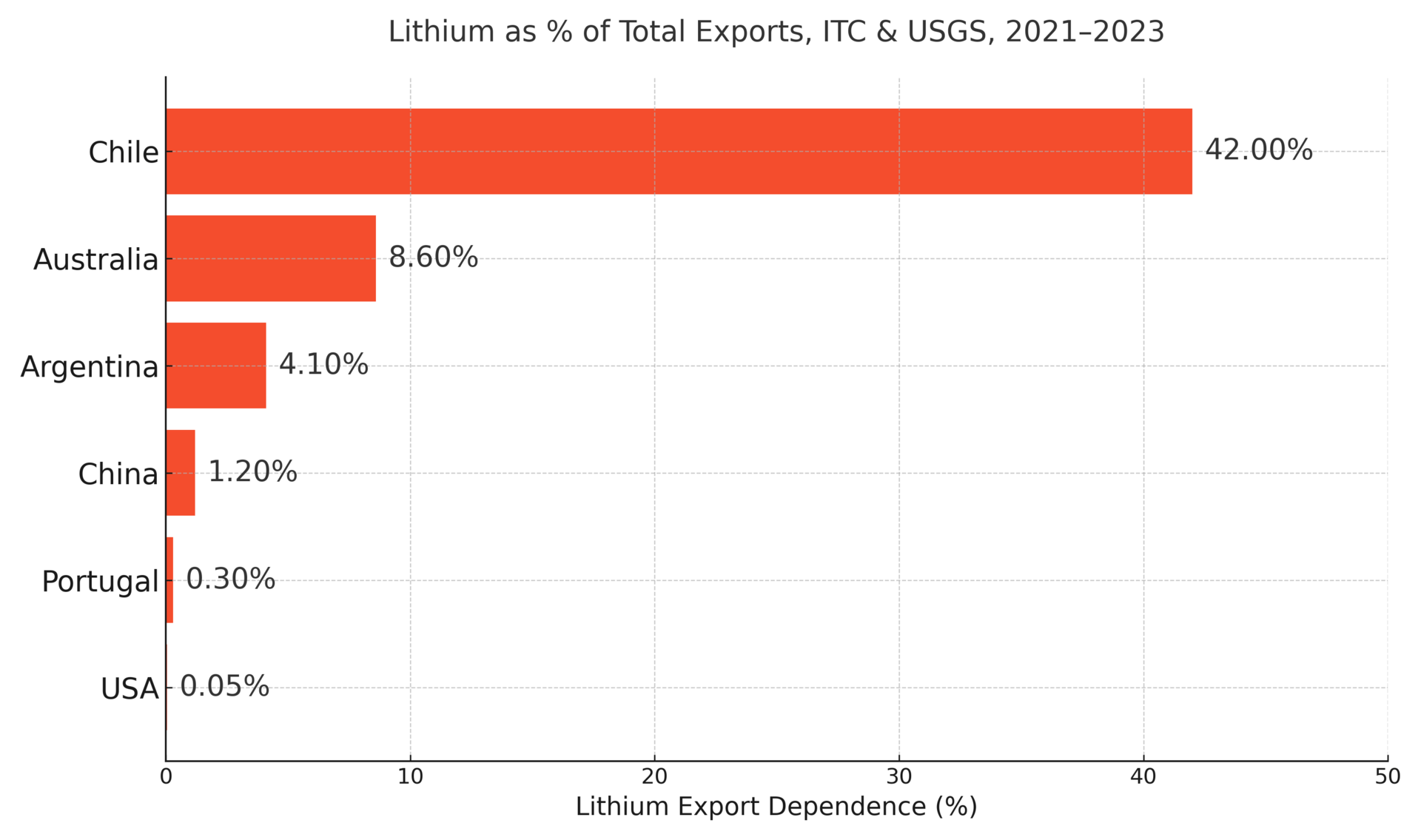

Chile holds one of the largest lithium reserves on Earth—a key ingredient in batteries for electric vehicles. Lithium now contributes over 40% of the country’s export earnings, surpassing even copper some years.

But this future-forward dependency comes with volatility. Lithium prices spiked, then crashed in 2023. Add in environmental backlash and local resistance in mining zones, and the picture becomes more complex.

Power stat: In 2022, lithium revenues surpassed copper for the first time in Chile’s history.

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

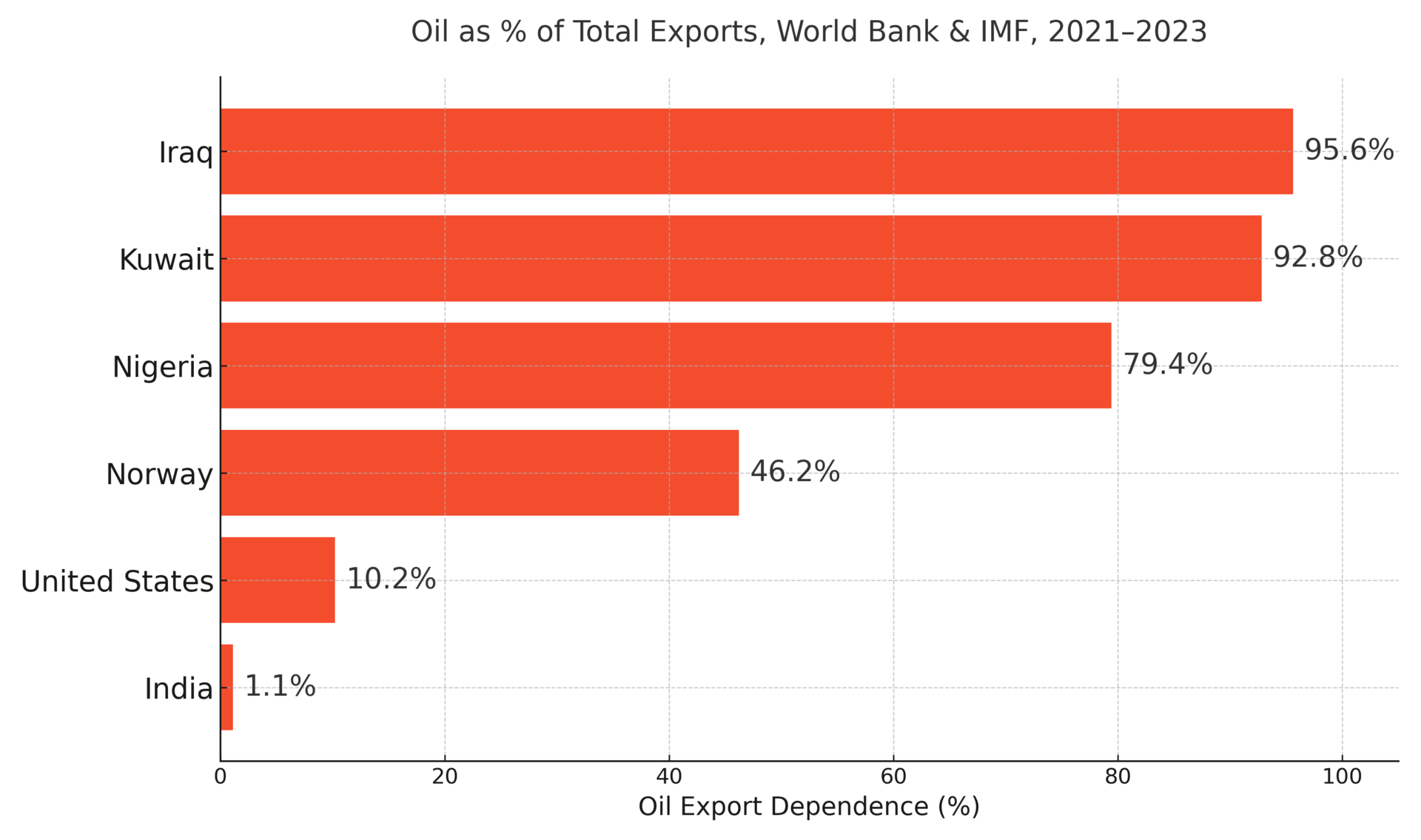

In Iraq, oil isn’t just a major export—it’s nearly the only one. Over 95% of government revenue comes from oil, making the economy exceptionally vulnerable to price shocks or OPEC disputes.

Though there are talks of reform, diversification is inching forward at best. Oil booms fund salaries and stability; busts bring unpaid public workers and unrest.

Sobering insight: In 2020, an oil price crash left Iraq unable to pay government salaries for months.

Botswana is a diamond-dependent economy—over 80% of its exports come from the gems. Yet unlike many resource-rich nations, Botswana has avoided the “resource curse” through fiscal discipline and investment in infrastructure and education.

Still, emerging threats loom. Lab-grown diamonds and shifting global luxury demand are pressing reminders that no commodity is forever.

Unexpected detail: Botswana is among Africa’s few nations to consistently run budget surpluses—despite diamond dependency.

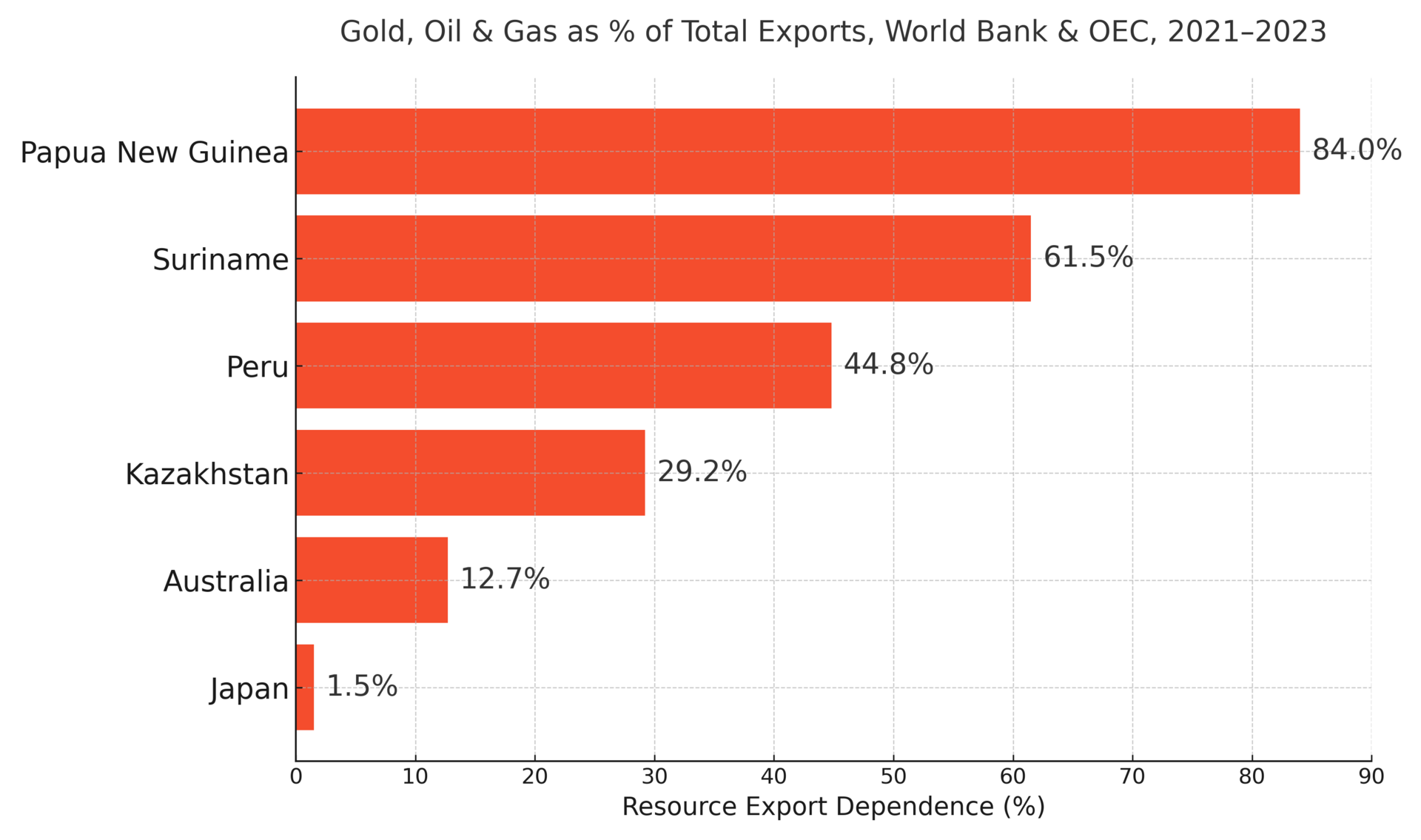

Papua New Guinea leans heavily on gold, oil, and gas—84% of total exports. But few locals benefit from these resources. Most mining and energy operations are foreign-led, and the profits rarely circulate within the country.

Add in frequent political disruptions and natural disasters, and PNG’s economic model teeters between potential and precarity.

Hard-hitting fact: In 2021, ExxonMobil’s gas exports alone made up over 30% of national exports, with minimal local impact.

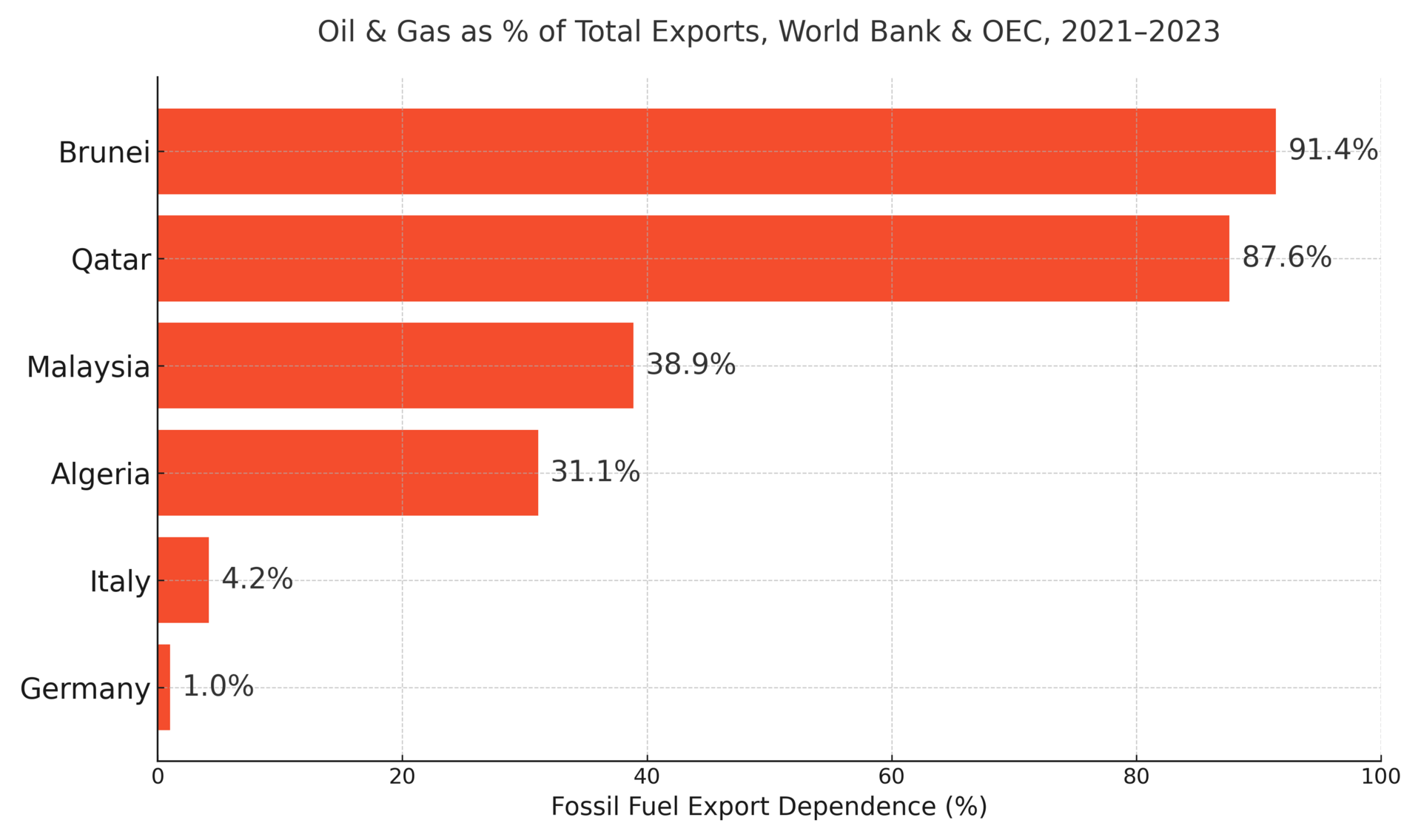

Brunei has long ridden a wave of oil and gas wealth. These two commodities represent over 90% of its export income, funding generous social programs and one of the highest GDPs per capita in Asia.

But its reserves are depleting, and diversification efforts remain slow. The country’s youth face limited job prospects beyond the energy sector.

Eye-opener: Without urgent reform, Brunei’s oil reserves may run dry by 2035—potentially triggering a dramatic economic shift.

From cocoa to lithium, diamonds to oil, putting all your chips on one export is a high-stakes gamble. When markets shift—and they always do—nations either pivot or plunge.

For globally minded readers like you, this isn’t just trivia. It’s a lens on where to live, invest, or steer clear.

In economies and in life, one rule holds true: diversify or risk it all.

Stay sharp. Stay curious. The world rewards those who watch where the money flows.

Warm regards,

Shane Fulmer

Founder, WorldPopulationReview.com

P.S. Want to sponsor this newsletter? Reach 139,000+ global-minded readers — click here!