- World Population Review Newsletter

- Posts

- Housing Bubble Watch: Where Not to Buy

Housing Bubble Watch: Where Not to Buy

Debt, risk, and red flags in today’s most volatile housing markets.

Greetings, sharp-eyed seeker of smart moves!

Around the world, housing markets are flashing signals—some red-hot, others red-alert. Prices are soaring, debt’s piling up, and bubbles may be swelling where you least expect.

Should you jump in? Or get out before the crash?

This edition cuts through the noise. We break down the real risks—and real opportunities—behind today’s housing headlines. Whether you’re hunting for your next investment or planning your great escape, these insights could save you thousands.

Let’s get to it.

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Canada’s real estate market, long seen as a safe haven, is now flashing some of the world’s brightest red flags.

🇨🇦 Canadian households carry the highest debt-to-income ratio among G7 nations—around 180%—driven largely by soaring mortgage loads. Toronto and Vancouver lead the way, where detached homes regularly exceed $1.5 million CAD, pricing out the middle class and pulling first-time buyers deep into debt.

And investors? They’ve poured in—over 30% of recent buyers in Ontario were investors, not residents. Combine that with stagnant wages and increasing interest rates, and you've got the perfect storm for a correction.

🔎 Did you know? Canada’s real estate sector accounts for over 10% of GDP, making the economy highly vulnerable to even modest price declines.

New Zealand’s housing market soared 40% during the pandemic. Now it’s facing reality.

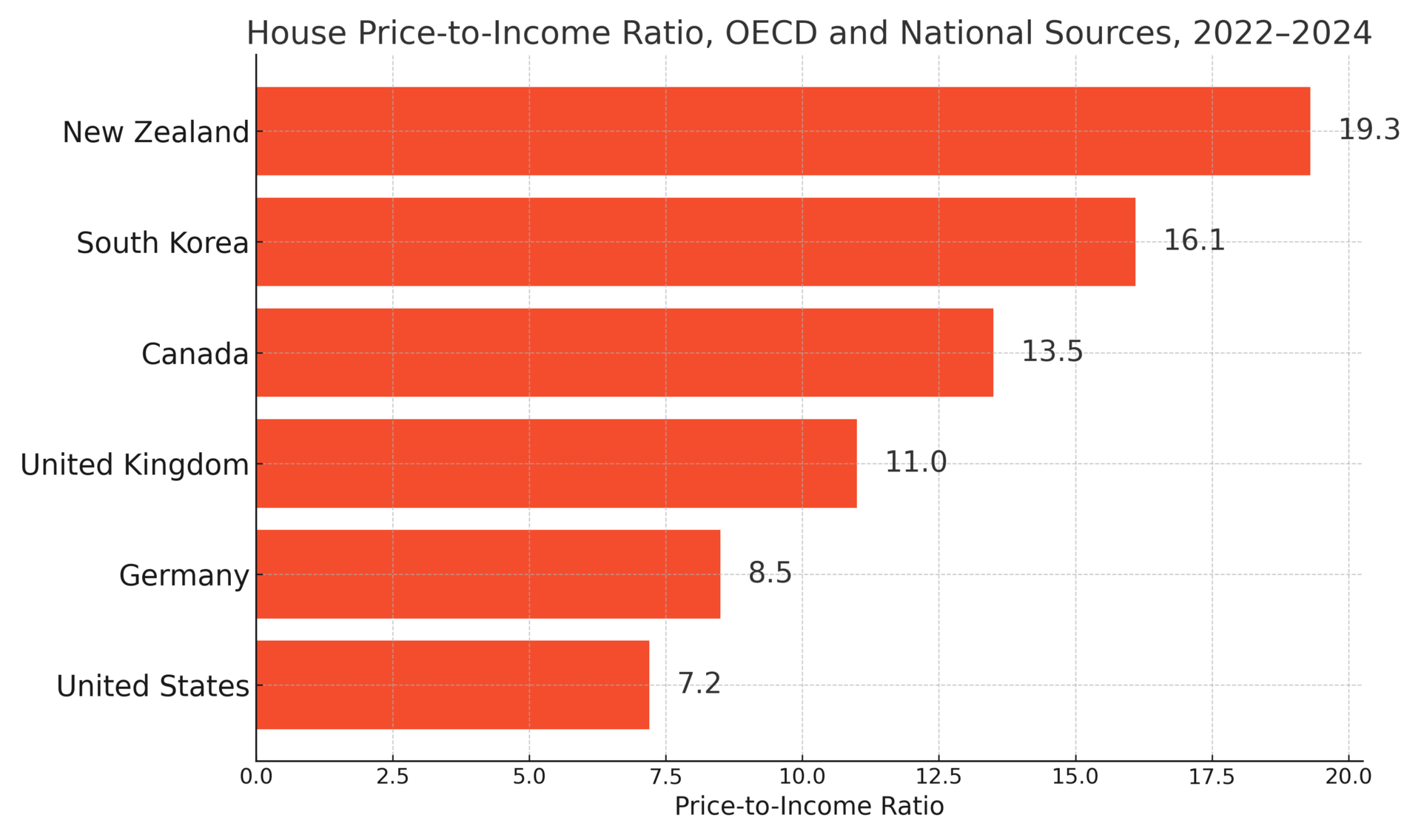

With the OECD’s highest house-price-to-income ratio, New Zealand has officially entered correction territory. Home values have dropped nearly 15% from their peak, and the country’s central bank has called housing “unsustainable” in its current form.

Auckland, the epicenter, has seen its average house price drop below NZ$1 million—but affordability is still a distant dream. The government’s attempts to curb speculation (including restrictions on foreign buyers) have only mildly cooled the investor frenzy.

🔎 In 2021, the average home in Auckland cost 10x the average income—a ratio worse than San Francisco or London.

Sweden offers a cautionary tale in real time.

Years of near-zero interest rates created a frothy housing market, with debt-fueled buying driving prices skyward. But since 2022, home prices have fallen by nearly 20%—among the sharpest declines in developed markets.

Swedes are highly leveraged, with mortgage debt around 190% of disposable income. And most mortgages in Sweden are on short-term variable rates, meaning households feel every policy shift immediately.

🔎 Fascinating twist: Sweden’s Financial Supervisory Authority has urged banks to stress-test mortgages at 7% interest, warning of systemic risks if rates stay elevated.

America’s housing market is no monolith—it’s a patchwork of boomtowns and bust zones.

Post-pandemic, cities like Austin, Boise, and Phoenix saw prices surge 40–60% in just two years—fueled by remote work, tech migration, and ultra-low rates. But that growth is reversing. Austin has seen home prices drop over 10%, and inventory is rising fast.

Meanwhile, the Sun Belt investor boom is cooling. In some metro areas, investors made up 20–30% of all purchases—a risk factor now that many are pulling back.

🔎 The U.S. housing affordability index hit its lowest point since 1985 in mid-2023, making even modest homes out of reach for many first-time buyers.

China’s housing market isn’t just about homeownership—it’s the foundation of the nation’s economic engine. And that engine is misfiring.

Developers like Evergrande and Country Garden have defaulted on massive debts. Ghost cities, half-finished towers, and declining home prices paint a stark picture. Property accounts for 70% of household wealth in China, so falling prices have far-reaching psychological and financial effects.

Local governments, heavily dependent on land sales, now face fiscal pressure. The central government is intervening—but real reform may take years.

🔎 In 2023, new home sales in China dropped by over 28%, the steepest decline on record.

For years, Germany was immune to housing froth. But post-2015, a surge in prices—especially in Berlin, Munich, and Frankfurt—turned heads.

Since 2022, prices have fallen about 10%, with construction slowing and financing costs doubling. Germany has historically low homeownership (~50%), so price volatility has different implications—but for investors and new buyers, the environment is precarious.

Unlike the U.S. or Canada, Germany’s mortgage market is more conservative. Still, housing costs are rising faster than wages, and rent controls in major cities are now under scrutiny for distorting supply.

🔎 A 2024 IMF report flagged Berlin as one of Europe’s most overvalued rental markets, relative to median incomes.

Not every market is flashing red.

Some countries are still in early stages of real estate development, or have fundamentals that support long-term growth rather than speculative bubbles.

🇹🇷 Turkey is volatile but attractive to cash buyers and retirees seeking value; Istanbul’s cost per square foot is a fraction of most European capitals.

🇨🇴 Colombia offers a low cost of living, a growing digital nomad scene, and urban regeneration in cities like Medellín—drawing foreign interest with property prices still affordable.

🇵🇹 Portugal’s inland regions (beyond Lisbon and Porto) remain undervalued, with EU residency incentives and a strong expat infrastructure.

🔎 Trend to watch: Countries with Golden Visa or digital nomad programs are becoming global magnets for real estate investment—often with better value and fewer bubble risks.

Real estate decisions shape your future—and data is your best defense.

This edition revealed where risk is rising fast—and where hidden value still exists. Debt, speculation, and rate hikes can spell trouble. But smart, data-driven choices? They open doors.

Keep asking questions. Keep scanning the map. The world’s best opportunities don’t shout—they whisper.

Until next time, stay sharp and stay ahead.

Warm regards,

Shane Fulmer

Founder, WorldPopulationReview.com

P.S. Want to sponsor this newsletter? Reach 127,000+ global-minded readers — click here!