- World Population Review Newsletter

- Posts

- Pension Time Bombs: Which Nations Will Survive?

Pension Time Bombs: Which Nations Will Survive?

Tracking the countries securing retirements—and those near collapse.

Greetings, discerning navigator of global realities!

Your pension isn’t just a number—it’s your future. And in many countries, that future is under siege. Aging populations, shrinking workforces, and shaky economies are straining systems to the breaking point.

Some nations are fighting back with bold reforms. Others are drifting toward disaster. The difference could mean a secure retirement… or years of unexpected work.

In this edition, we uncover where pensions are rock-solid—and where they’re on borrowed time.

Let’s dive in.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Europe’s generous pension systems are facing their greatest test yet. Low birth rates and long life expectancy mean fewer workers supporting more retirees—a formula for fiscal strain.

🇫🇷 France recently raised its retirement age from 62 to 64, sparking nationwide protests. The change aims to shore up a system where public pensions already eat up 14% of GDP.

🇮🇹 Italy is even more strained, with one of the oldest populations in the world and pension spending near 16% of GDP—highest in the OECD.

🇸🇪 Sweden, in contrast, runs a flexible “notional defined contribution” model tied to life expectancy. This automatic adjustment keeps the system solvent without sudden political battles.

Perspective: If you’re looking to retire in Europe, seek countries like Sweden that build sustainability into the system.

Fascinating fact: In Italy, by 2050, there may be just 1.3 workers for every retiree—down from 4-to-1 in 1980.

🇺🇸 America’s Social Security trust fund is projected to be depleted by 2033. Without reform, benefits would drop by roughly 23%.

The U.S. has a relatively low replacement rate (about 37% of pre-retirement income), so many retirees already rely heavily on personal savings or work beyond 65.

Proposals on the table include raising the payroll tax cap, gradually increasing retirement ages, and means-testing benefits for higher earners.

While state and municipal pensions vary, many are underfunded—Illinois and New Jersey among the worst.

Perspective: For Americans, diversifying retirement income beyond Social Security is no longer optional—it’s survival planning.

Surprising stat: Nearly 1 in 5 Americans over 65 is still working—the highest share in over 50 years.

🇯🇵 With nearly 30% of its population over 65, Japan faces staggering pension pressures.

The national pension system relies heavily on current workers, but the workforce is shrinking fast.

Japan’s Government Pension Investment Fund, the largest in the world, manages over $1.6 trillion—but payouts are still projected to outpace contributions in the coming decades.

Policies encouraging older workers to stay employed and incentives for private savings are central to their strategy.

Perspective: Japan offers a cautionary tale—wealthy nations can still face insolvency without demographic balance.

Unexpected detail: Japan sells more adult diapers than baby diapers—a stark symbol of its demographic reality.

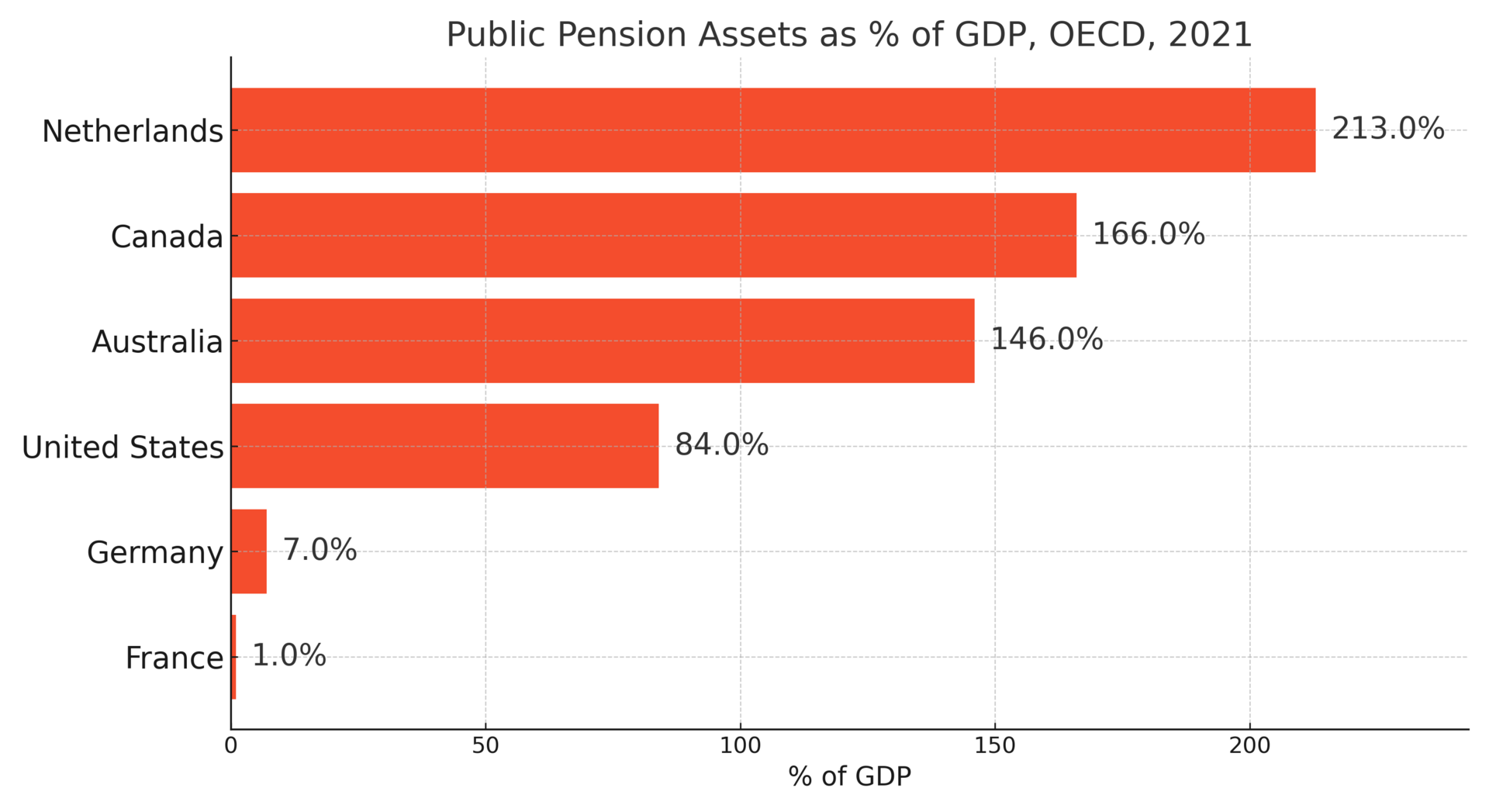

🇨🇦 Canada’s pension system consistently ranks among the most sustainable globally.

The Canada Pension Plan (CPP) underwent major reforms in the late 1990s, shifting to full funding and creating an independent investment board now managing over C$570 billion.

Combined with Old Age Security and private savings, most retirees receive about 50% of pre-retirement earnings.

Rising immigration is also helping to stabilize worker-to-retiree ratios—an advantage Europe lacks.

Perspective: For those considering relocation, Canada’s pension reforms and diversified funding make it one of the safer bets in the West.

Little-known fact: The CPP Investment Board invests in over 50 countries, from infrastructure in India to wind farms in Europe.

🇦🇺 Australia runs a hybrid system: a public Age Pension plus mandatory private “superannuation” contributions from employers (currently 11%, rising to 12% by 2025).

This model dramatically reduces the burden on public finances.

The national superannuation pool is now worth over A$3.5 trillion—more than Australia’s GDP.

However, rising housing costs and longer life expectancy could pressure payouts in decades ahead.

Perspective: Mandatory private savings give retirees more control—but require decades of steady contributions to fully deliver.

Surprising stat: Australians are among the world’s richest retirees by median net wealth—largely due to home ownership and superannuation growth.

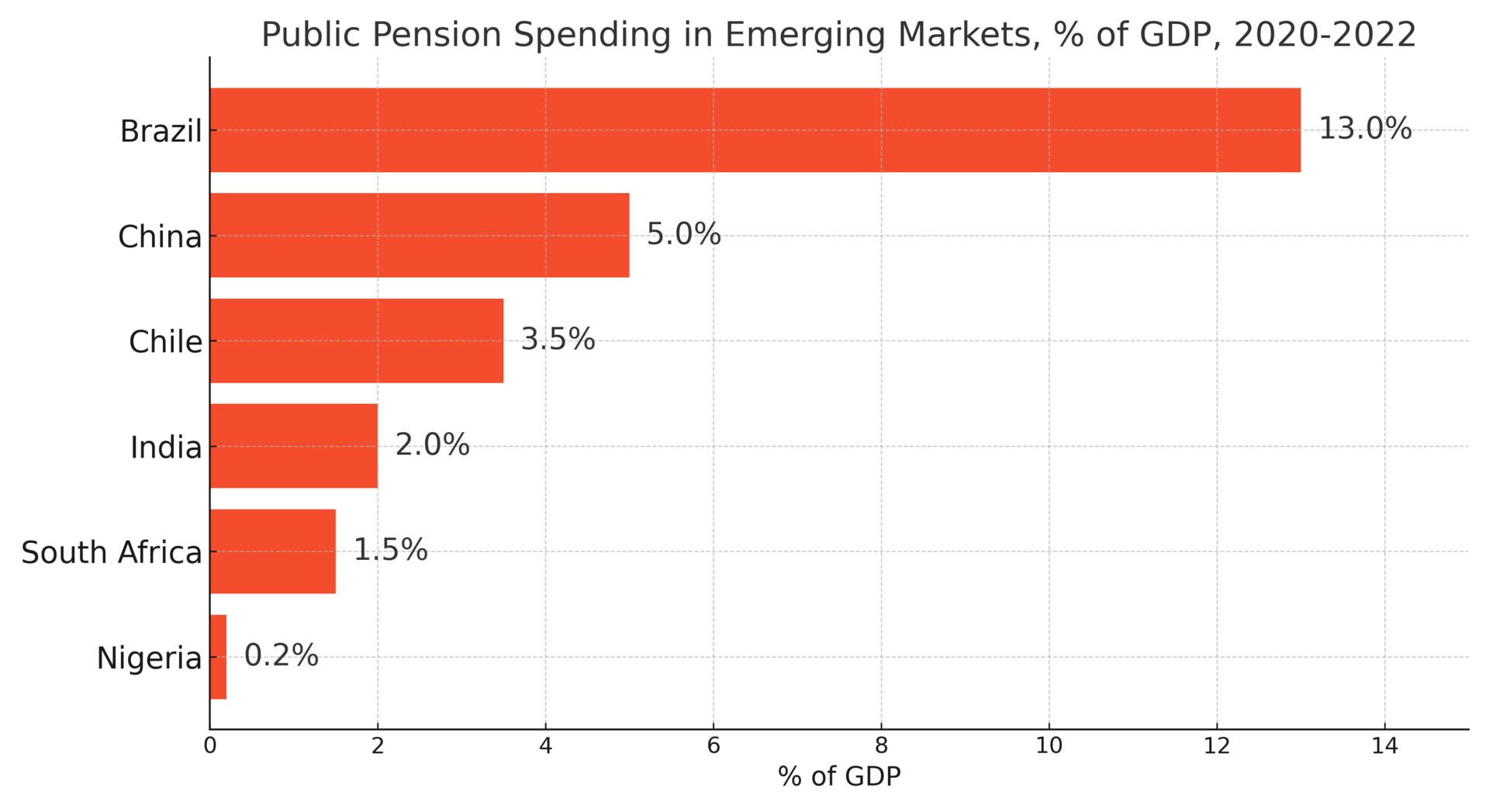

📈 Middle-income nations are facing pension strain before becoming rich—a phenomenon the World Bank calls “getting old before getting rich.”

🇧🇷 Brazil spends a higher share of GDP on pensions than many richer nations, despite a much younger population.

🇨🇳 China has rapidly expanded pension coverage, but rural benefits remain small, and the urban fund could face deficits by the 2030s.

🇨🇱 Chile pioneered private pensions in the 1980s, but low contributions have left many retirees struggling—prompting a recent shift back toward public support.

Perspective: Investing or retiring in emerging markets demands careful scrutiny of both inflation risk and the stability of payouts.

Unusual fact: In China, the retirement age for women can be as low as 50 in some industries—one of the lowest in the world.

🌍 Across the globe, pension survival depends on three levers: retirement age, contributions, and returns on investment.

Countries with automatic adjustments—like Sweden and Canada—are far better prepared than those dependent on politically risky reforms.

Private savings, diversified across assets and geographies, are becoming as important as public pensions.

The rise of remote work and “active retirement” could redefine what leaving the workforce looks like.

Perspective: The retirement of the future is less about a fixed age and more about phased transitions, multiple income streams, and lifelong learning.

Fascinating projection: By 2050, the number of people over 80 will triple globally—creating unprecedented demand for healthcare, senior housing, and age-friendly infrastructure.

Retirement security is no longer just a personal finance issue—it’s a global economic challenge.

By understanding which systems are built to last and which are cracking under pressure, you can make smarter decisions about where to live, invest, and plan for your later years.

Warm regards,

Shane Fulmer

Founder, WorldPopulationReview.com

P.S. Want to sponsor this newsletter? Reach 126,000+ global-minded readers — click here!