- World Population Review Newsletter

- Posts

- Regulatory Pressure Is Reshaping Crypto Fast

Regulatory Pressure Is Reshaping Crypto Fast

From MiCA to SEC wars, the legal squeeze on crypto is accelerating.

Greetings, inquisitive mind of financial frontiers!

Crypto promised freedom. Now it’s facing fire. Around the globe, regulators are drawing lines—some opening doors, others slamming them shut.

From Europe’s sweeping MiCA laws to U.S. courtroom brawls, the crypto map is being rewritten. And for anyone investing, building, or relocating, knowing the rules may matter more than knowing the code.

This week, we track where crypto is gaining ground—and where it’s losing air.

Let’s dive in.

Hands Down Some Of The Best 0% Intro APR Credit Cards

Balance Transfer cards can help you pay off high-interest debt faster. The FinanceBuzz editors reviewed dozens of cards with 0% intro APR offers for balance transfers and found the perfect cards.

Take a look at this article to find out how you can pay no interest on balance transfers until 2027 with these top cards.

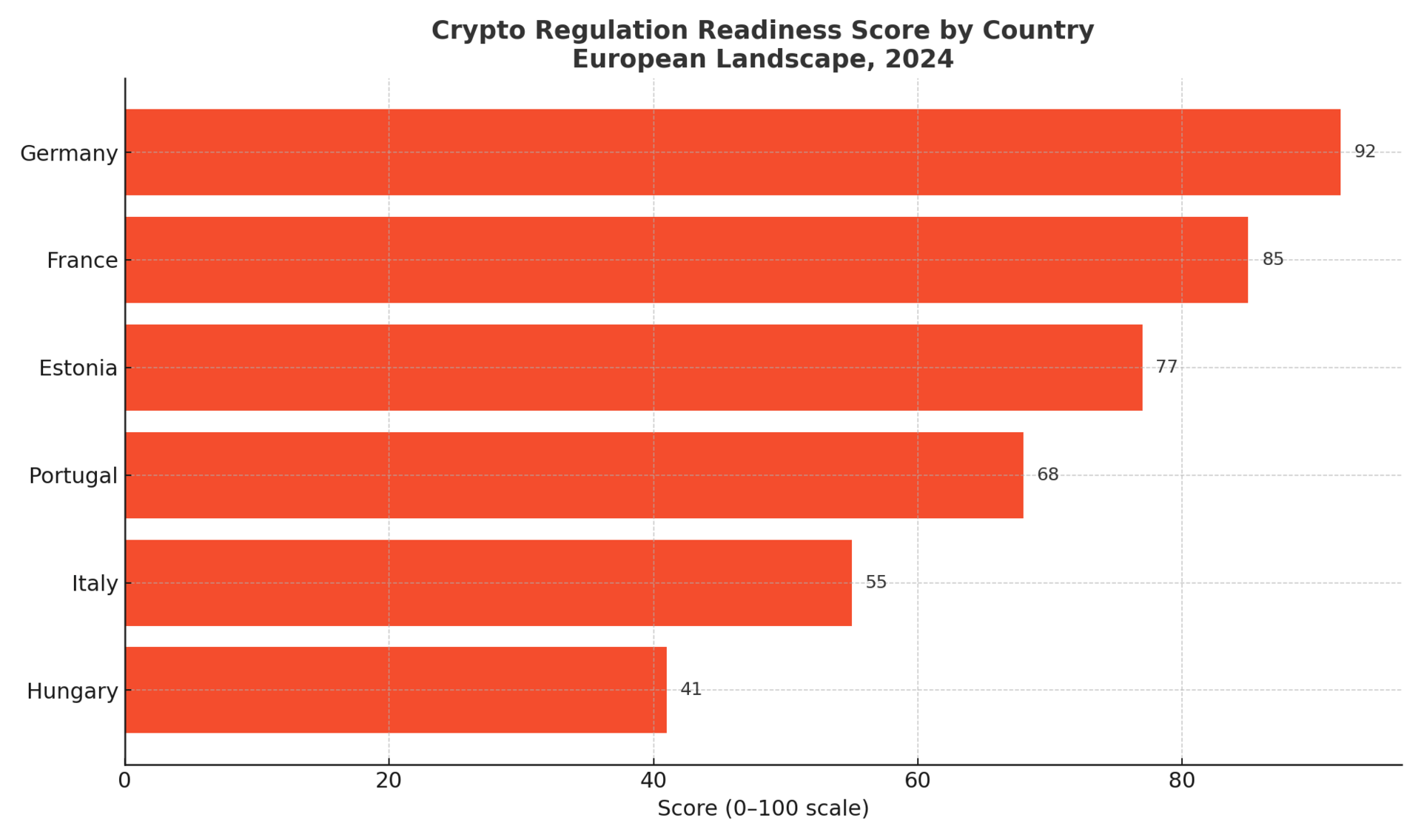

Europe is betting that rules will build trust, not kill innovation. With the Markets in Crypto-Assets (MiCA) regulation now in force, the EU has taken the lead on creating a unified legal framework for crypto.

MiCA requires crypto companies to obtain licenses, disclose risks, and protect consumer assets—no more fly-by-night exchanges. This clarity is attracting major players. Binance, for instance, has pivoted operations to Paris and other crypto-friendly EU hubs.

🇩🇪 Germany is becoming a major beneficiary, with institutions like Deutsche Bank launching crypto custody services.

Meanwhile, 🇪🇪 Estonia is cracking down on ghost firms with tighter licensing laws, ensuring only real operators survive.

💡 Surprising detail: MiCA covers stablecoins too—and imposes strict reserve requirements. Any euro-backed stablecoin must be fully backed by assets and capped in usage.

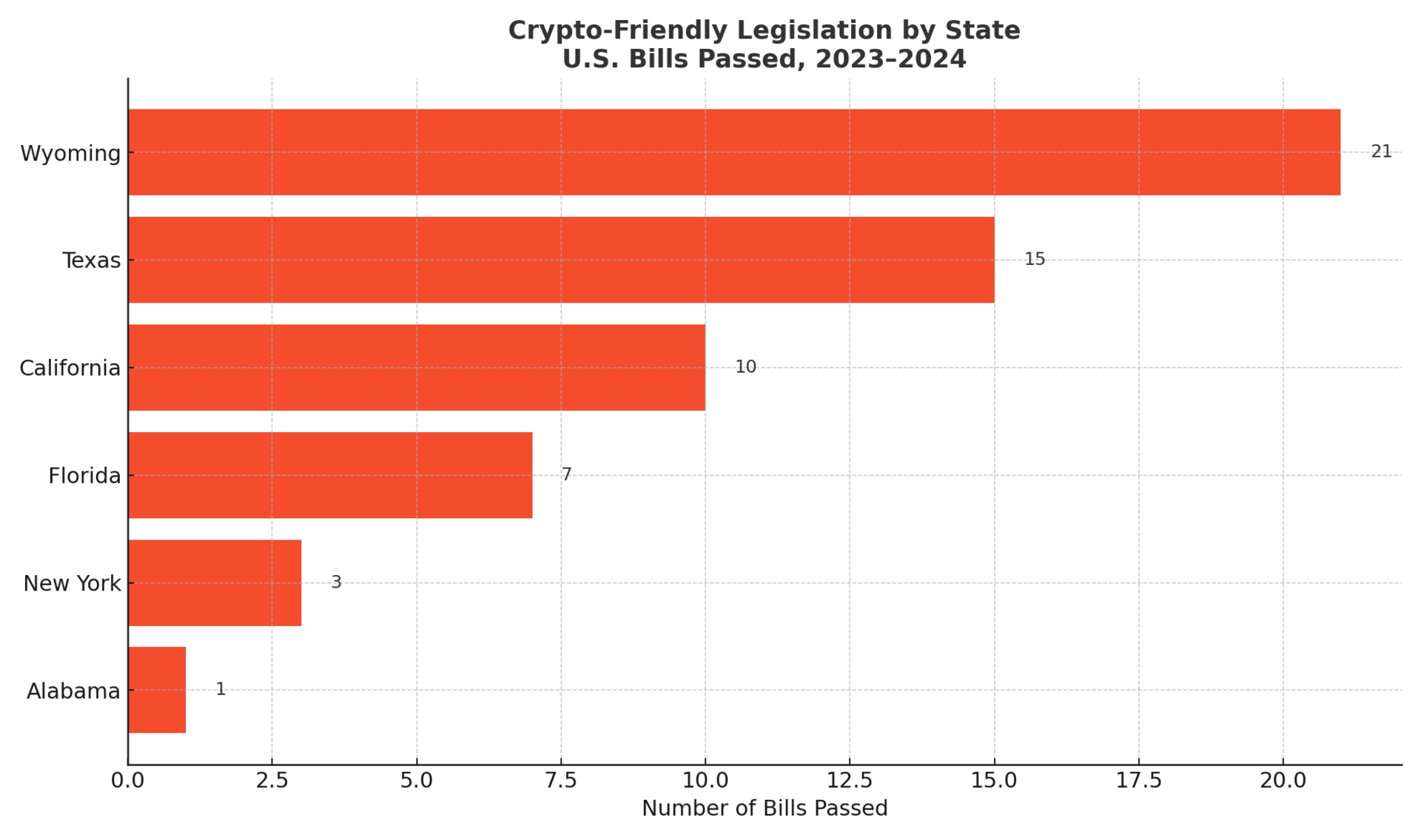

The U.S. crypto scene is a legal battlefield. With the SEC suing major exchanges like Coinbase and Binance, and Congress still undecided on how to classify crypto—as securities, commodities, or something else entirely—the uncertainty is chilling innovation.

Still, not all is chaos. States like Wyoming and Texas are creating their own crypto-friendly laws. Wyoming now even recognizes DAOs (Decentralized Autonomous Organizations) as legal entities.

Silicon Valley startups are eyeing relocation. 🌍 Dubai, 🇨🇭 Zug, and 🇸🇬 Singapore are top destinations for those seeking clearer regulatory waters.

📉 Did you know? Over $1.3 billion in U.S. crypto venture funding fled overseas in just the first half of 2024.

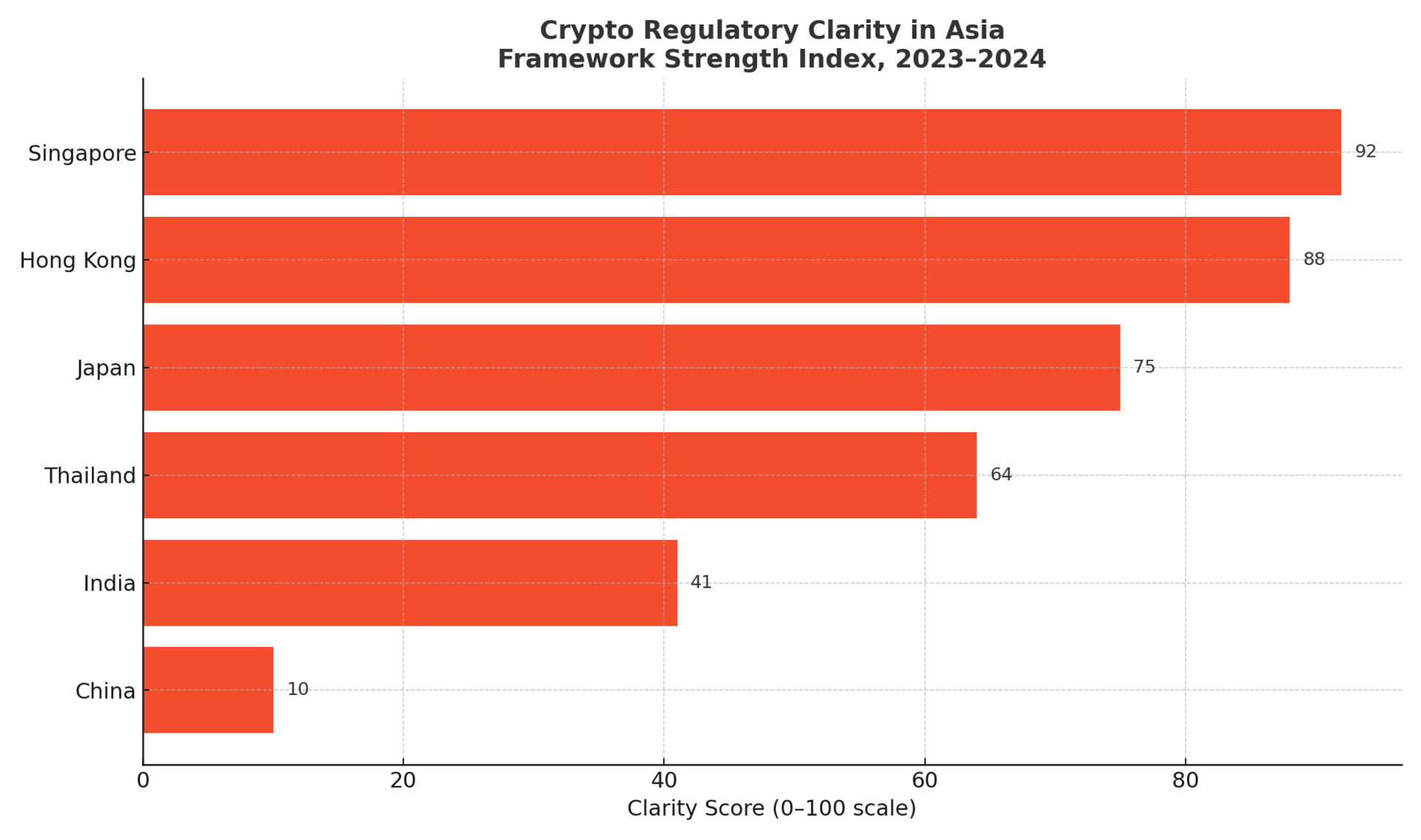

While 🇨🇳 China remains a hard “no” on crypto trading and mining, nearby regions are taking the opposite approach.

🇸🇬 Singapore has earned a reputation as Asia’s most regulated haven. Its Payment Services Act and clear licensing process have made it a magnet for crypto firms like Ripple and Crypto.com.

🇭🇰 Hong Kong is catching up fast. After years of ambiguity, it launched a retail-friendly licensing regime in 2023. The message: we’re open to crypto—but only if it plays by the rules.

💼 Unexpected twist: In 2024, Hong Kong’s Securities and Futures Commission added over 30 tokens for legal retail trading—more than many Western nations.

Become An AI Expert In Just 5 Minutes

If you’re a decision maker at your company, you need to be on the bleeding edge of, well, everything. But before you go signing up for seminars, conferences, lunch ‘n learns, and all that jazz, just know there’s a far better (and simpler) way: Subscribing to The Deep View.

This daily newsletter condenses everything you need to know about the latest and greatest AI developments into a 5-minute read. Squeeze it into your morning coffee break and before you know it, you’ll be an expert too.

Subscribe right here. It’s totally free, wildly informative, and trusted by 600,000+ readers at Google, Meta, Microsoft, and beyond.

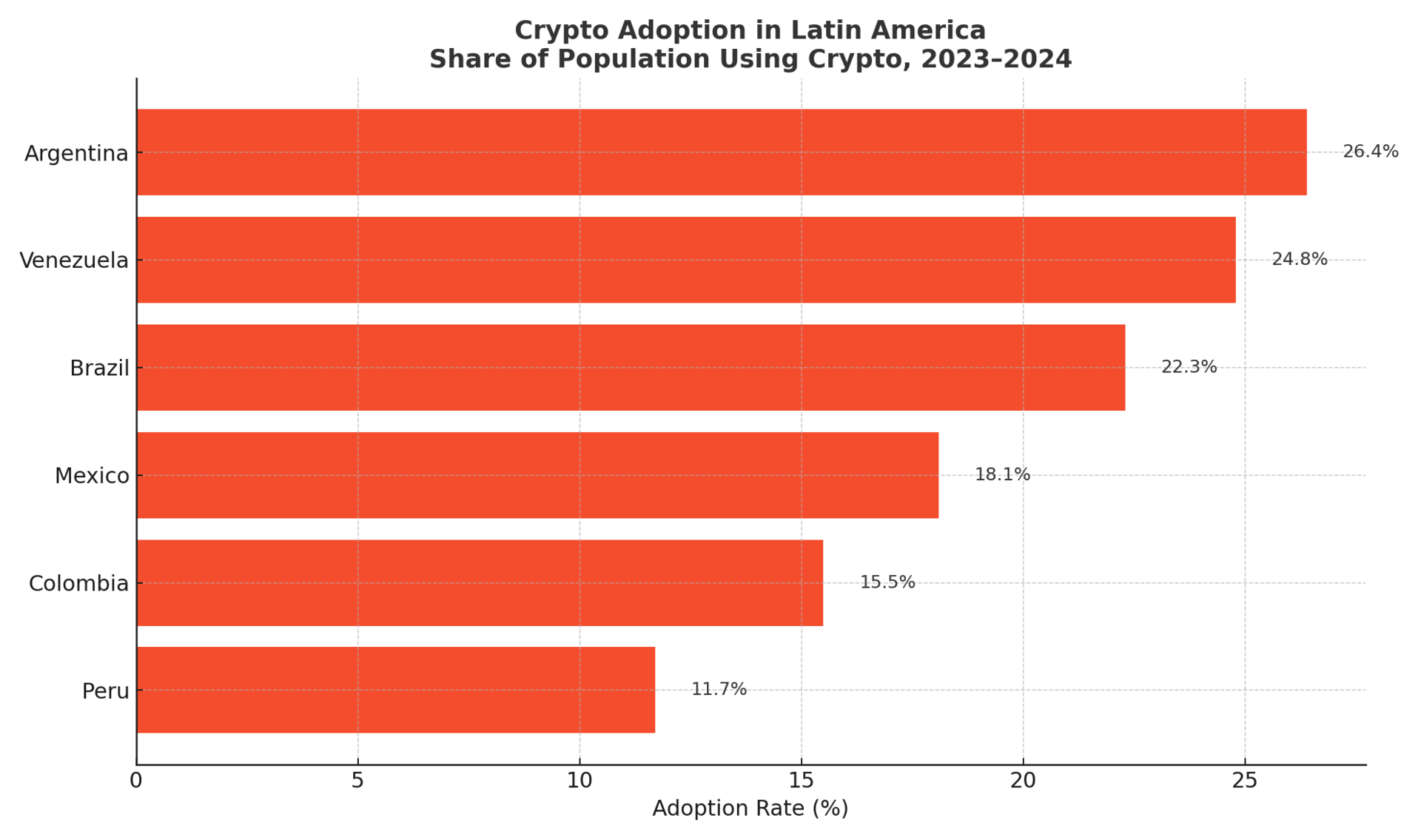

Crypto in Latin America isn’t just a trend—it’s a survival tool. In nations battling inflation and banking instability, digital currencies are offering real alternatives.

🇦🇷 Argentina has one of the world’s highest crypto adoption rates, fueled by inflation exceeding 200%. 🇧🇷 Brazil launched Drex—its CBDC pilot—and passed crypto regulation laws.

🇲🇽 Mexico is developing its own framework, due by 2025.

🇸🇻 El Salvador remains a controversial pioneer. Its Bitcoin experiment attracted both ridicule and international crypto investment.

📊 Perspective shift: In 🇻🇪 Venezuela, despite harsh mining crackdowns, P2P crypto trading volume remains among the world’s highest—a quiet revolution enabled by blockchain.

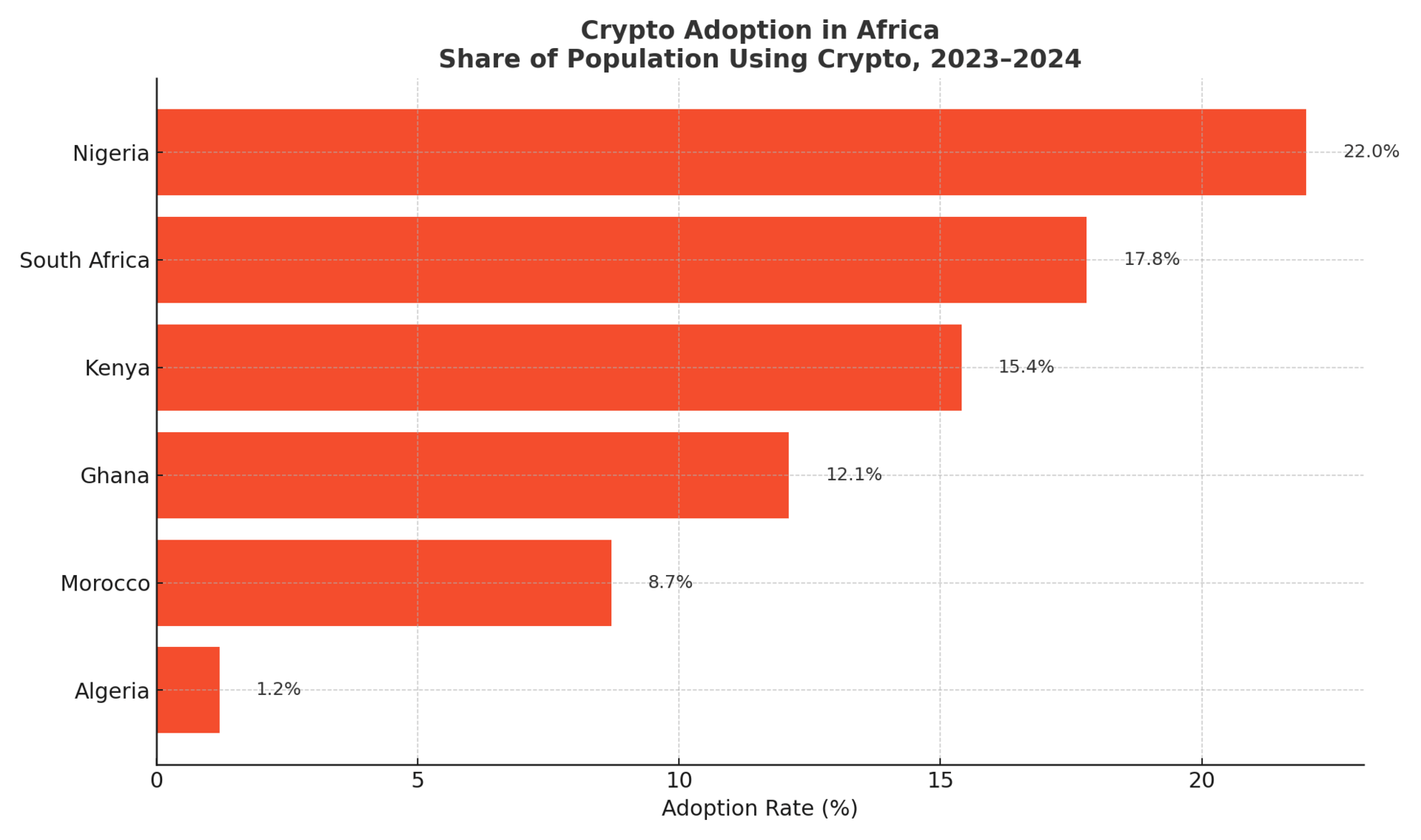

Africa’s crypto landscape is starkly split between skeptical governments and tech-savvy users.

🇳🇬 Nigeria banned crypto transactions via banks, yet launched the eNaira, its own CBDC. Still, citizens prefer P2P crypto trading, with platforms like Paxful booming.

🇿🇦 South Africa took a more balanced route, classifying crypto as a financial product in 2023 and requiring provider licenses.

🇰🇪 Kenya, a fintech leader with its massive mobile money ecosystem, is exploring crypto regulation slowly and cautiously.

🔍 Eye-opening insight: Over 10% of global crypto users are in Africa—yet less than 1% of crypto exchanges are based there.

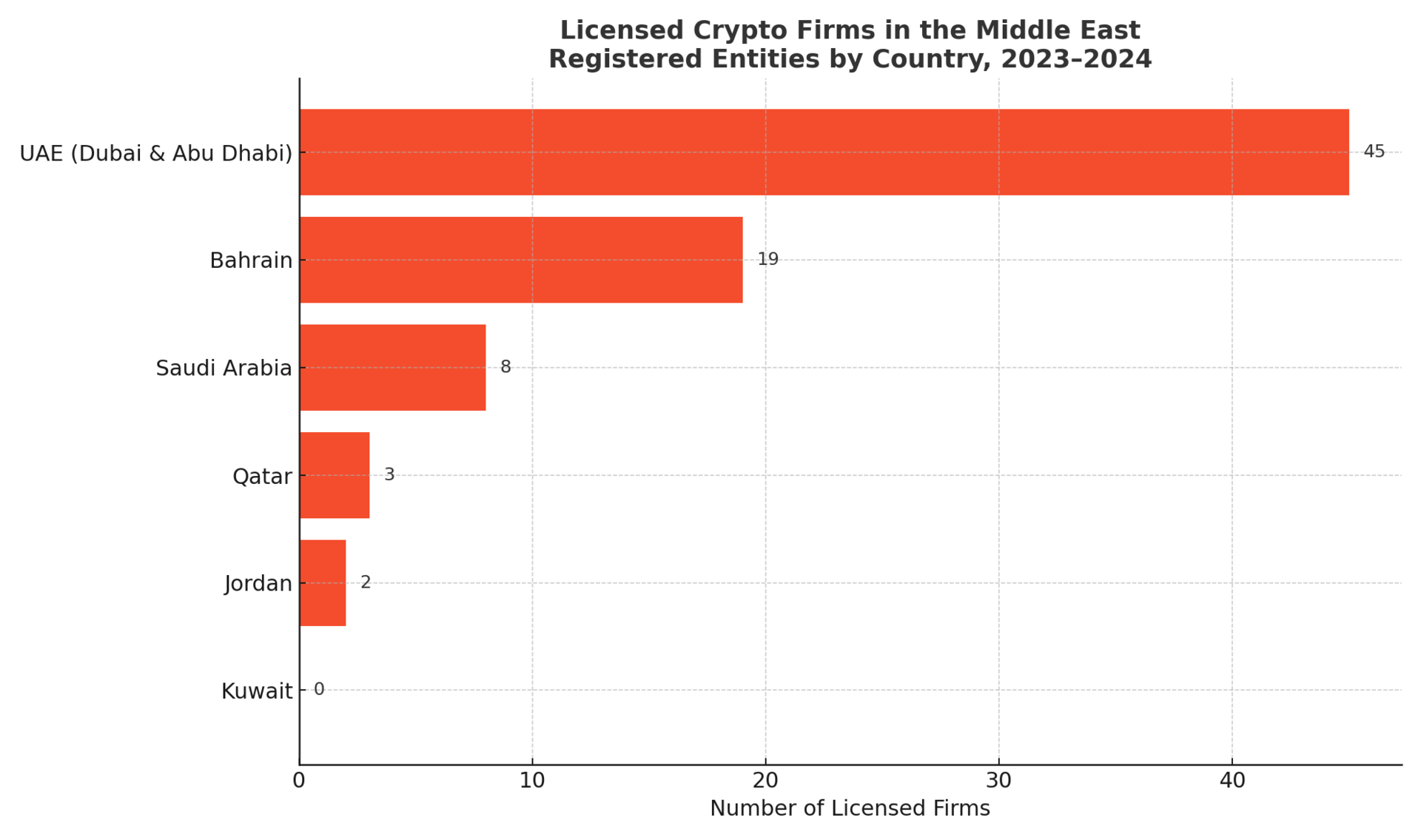

The Gulf is racing to become the Web3 capital of the world. 🇦🇪 Dubai, in particular, has emerged as a crypto juggernaut.

The Virtual Assets Regulatory Authority (VARA) licenses everything from exchanges to custodians, providing unmatched legal clarity. Abu Dhabi is rolling out similar systems, drawing institutional capital and talent.

Meanwhile, 🇸🇦 Saudi Arabia is investing in blockchain for cross-border payments and smart contracts—especially in its massive energy sector.

⚡ Forecast to watch: Dubai aims to attract 1,000+ blockchain companies by 2026—and it’s already halfway there.

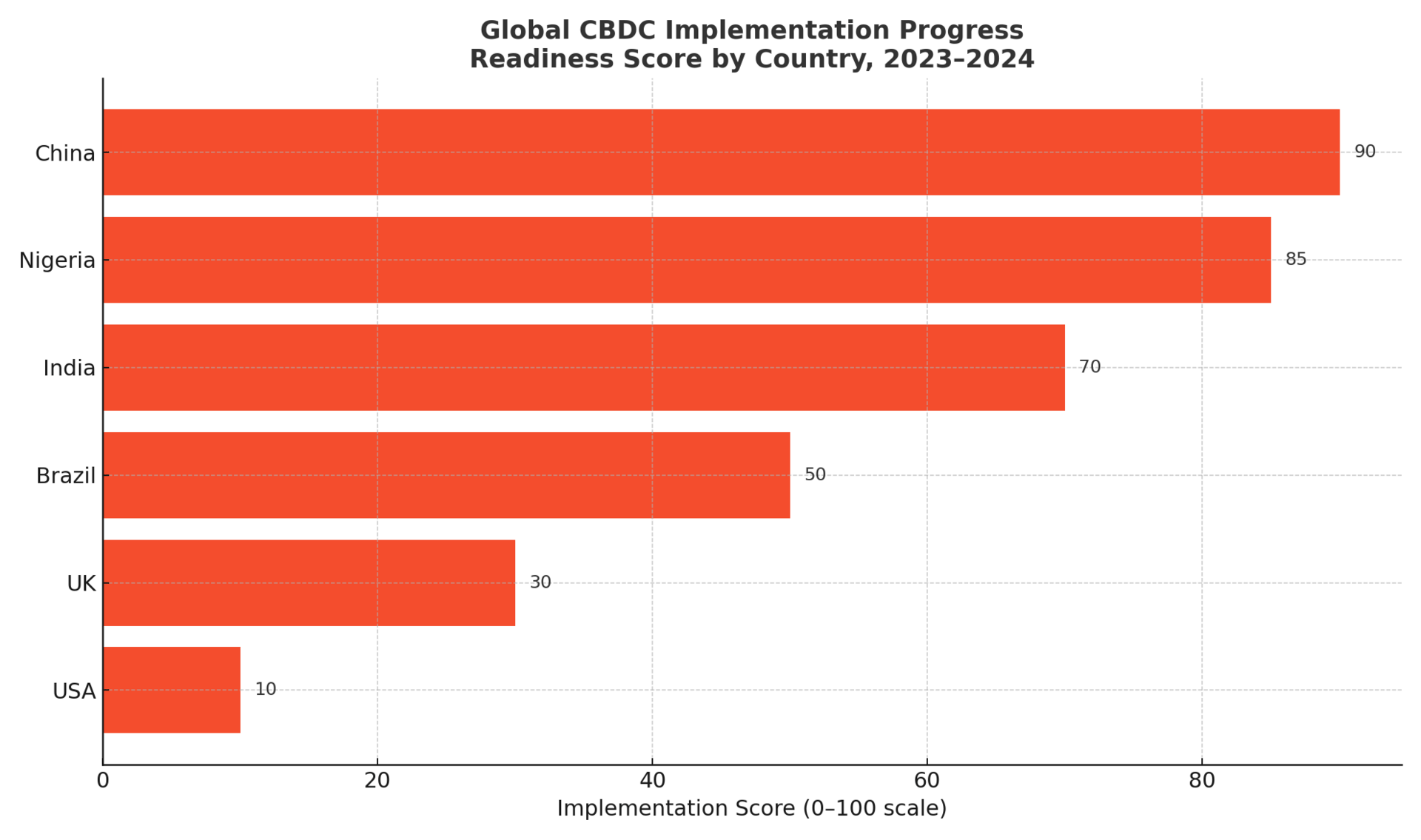

The key question now: will crypto regulation unite—or fracture—the world?

Global groups like the G20, IMF, and FATF are pushing for coordination. But results are mixed. While the EU’s MiCA may serve as a blueprint, countries like 🇮🇳 India continue to impose heavy taxes and delay regulatory clarity.

CBDCs (central bank digital currencies) are gaining momentum—sometimes in contradiction to crypto principles.

🌐 Bold projection: By 2030, over 70 countries will pilot CBDCs—but only a handful will achieve fully harmonized crypto laws. Expect opportunity—and chaos—in equal measure.

Crypto disrupted power. Now power’s disrupting back.

As nations race to regulate, the map matters more than the tech. For anyone eyeing their next investment, venture, or escape hatch—knowing the legal terrain is non-negotiable.

The future’s fragmenting fast. Some doors are opening. Others are slamming shut.

Stay sharp. Stay curious. The world is rewriting the rules—don’t get left behind.

Warm regards,

Shane Fulmer

Founder, WorldPopulationReview.com

P.S. Want to sponsor this newsletter? Reach 139,000+ global-minded readers — click here!