- World Population Review Newsletter

- Posts

- The Secret Investors Shaping Your Next Decade

The Secret Investors Shaping Your Next Decade

Inside the global flow of stealth capital—and why it impacts you.

Greetings, curious mind of hidden forces and global plays.

While headlines chase noise, real power moves in silence. From sovereign wealth funds to stealth VC, a quiet class of capital is shaping the future—one discreet investment at a time.

In this edition, we expose where the world’s most elusive money is flowing—and why it could shape where you live, invest, or retire next.

Let’s follow the capital others overlook.

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

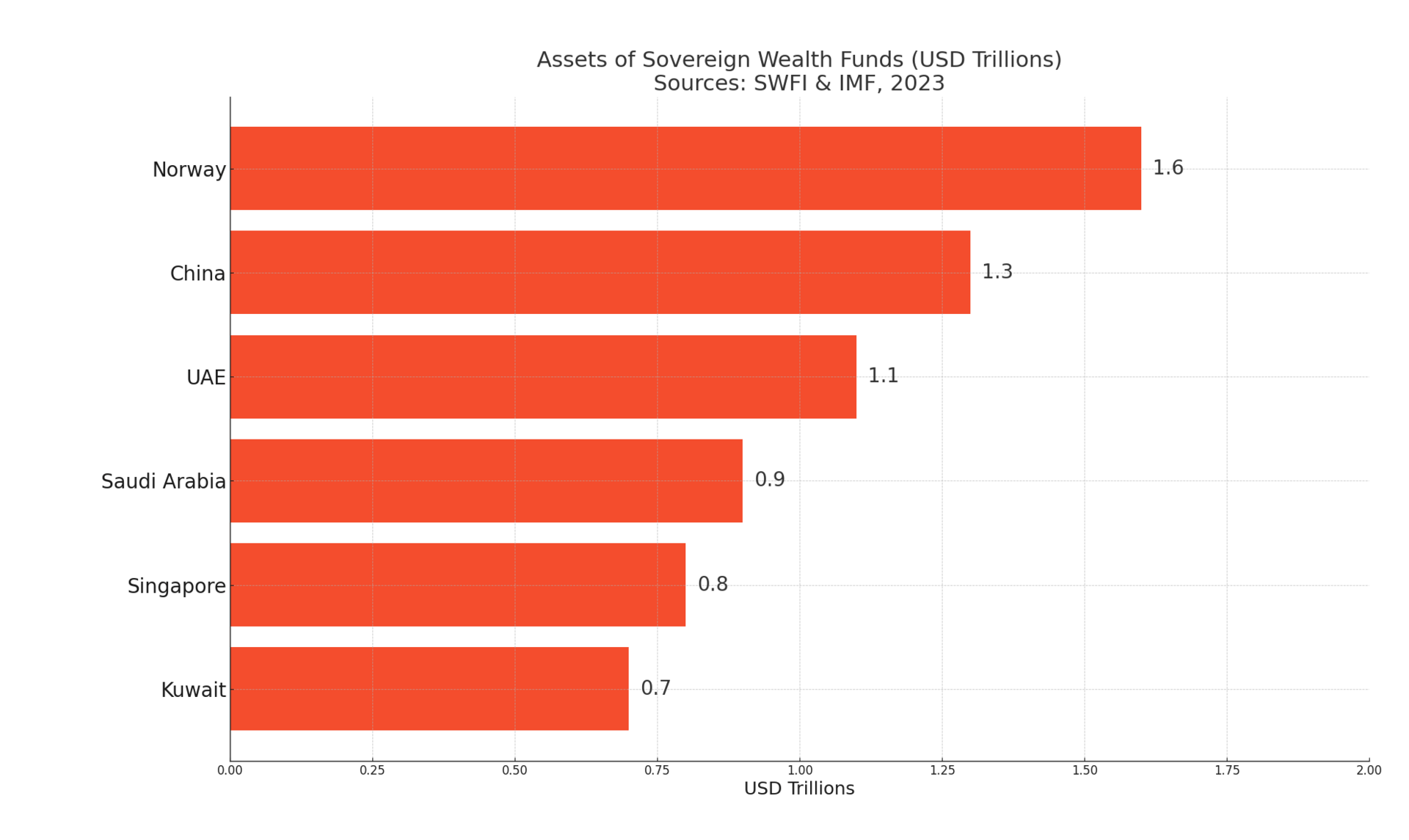

It may surprise you that the world’s largest sovereign wealth fund, Norway’s Government Pension Fund Global, doesn’t just invest in Norway—or even Europe. Quietly managing over $1.6 trillion, it owns stakes in 9,000+ companies across 70+ countries, from Silicon Valley startups to emerging green energy giants in Southeast Asia.

While ESG is its public mantra, Norway’s fund has been funneling capital into high-growth sectors like AI, cybersecurity, and biotech—and increasingly into the Global South. In 2023, the fund raised stakes in India’s infrastructure and Brazil’s energy markets, signaling a deeper strategic pivot.

🧠 Curious stat: Norway’s fund owns 1.5% of all listed stocks in the world—a silent force behind boardroom decisions you’ll never hear about.

Dubai dazzles with skyscrapers, but it’s Abu Dhabi’s Mubadala Investment Company and ADQ that are quietly building influence on a global scale. With combined assets exceeding $1 trillion, these funds are investing in quantum computing, genomics, and even Hollywood production companies.

But their goals go beyond ROI. By backing critical tech in the West and funding food security and health tech in Africa and Asia, the UAE is positioning itself as a geopolitical balancer, leveraging capital in place of military might.

Recently, Mubadala took a $1.5B stake in a U.S.-based chipmaker, while ADQ doubled down on Egypt’s pharma sector—moves that reveal a strategy far broader than profit.

🕵️ Unexpected insight: The UAE is now one of the top five investors in U.S. startups valued over $1B—despite rarely making headlines.

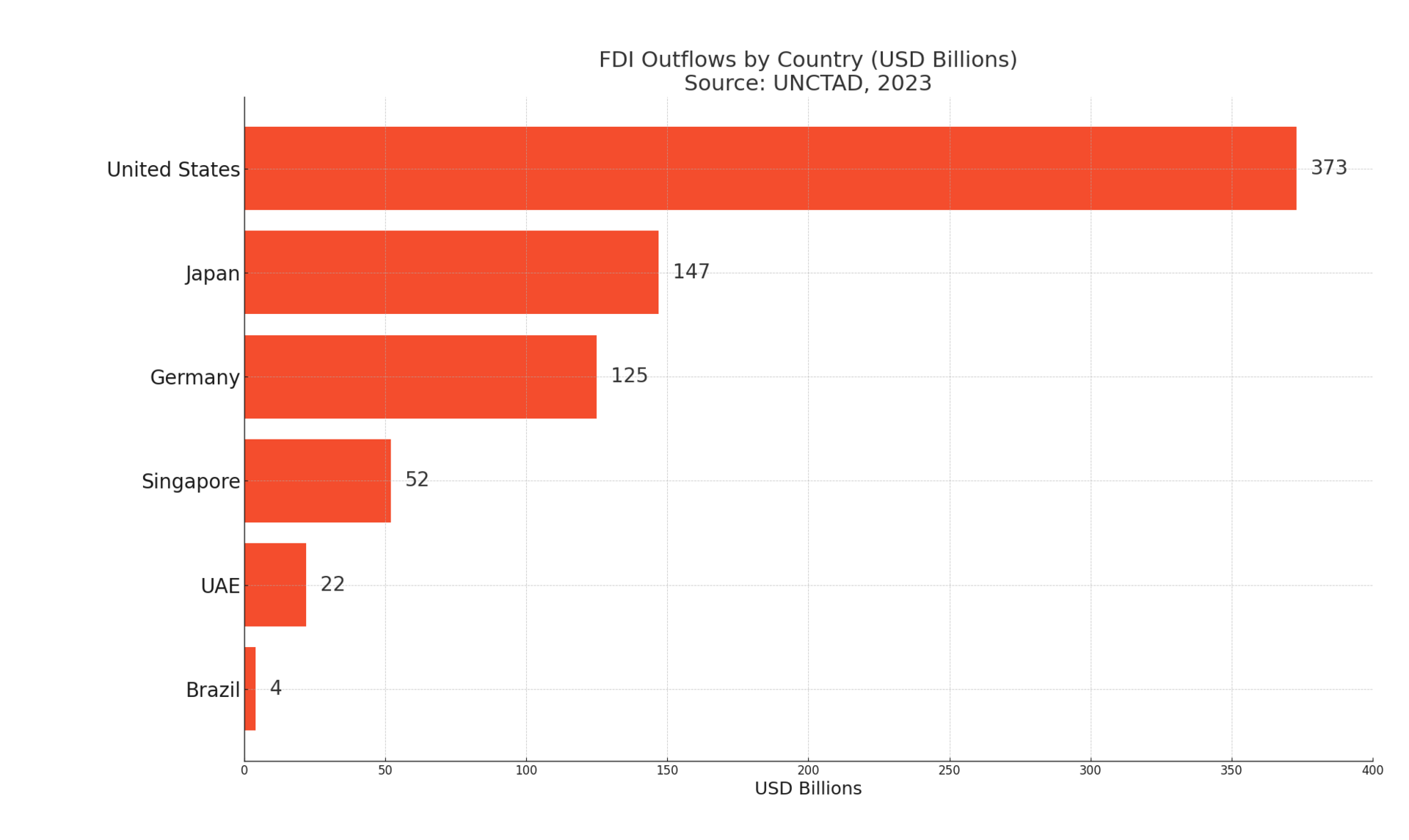

This chart shows Foreign Direct Investment (FDI) outflows—the amount of money countries invested abroad in 2023.

You’ve heard of Sequoia and Andreessen. But many of the most aggressive early-stage bets are now coming from stealth-mode venture firms—often run by former founders or family offices with no PR teams, no public portfolios, and zero media interest.

Why the secrecy? These players seek to avoid competitive signaling, regulatory scrutiny, and hype bubbles. They're hunting long plays—space tech, nuclear fusion, rural AI, synthetic biology—often years before the mainstream catches on.

A notable example: “NoLabel Capital,” a pseudonymous family-backed firm, seeded a now-$4B startup in agri-AI without appearing in a single press release.

💡 Key takeaway: The next major IPO might be backed not by Silicon Valley royalty, but by someone you’ve never heard of—by design.

Here’s an un-boring way to invest that billionaires have quietly leveraged for decades

If you have enough money that you think about buckets for your capital…

Ever invest in something you know will have low returns—just for the sake of diversifying?

CDs… Bonds… REITs… :(

Sure, these “boring” investments have some merits. But you probably overlooked one historically exclusive asset class:

It’s been famously leveraged by billionaires like Bezos and Gates, but just never been widely accessible until now.

It outpaced the S&P 500 (!) overall WITH low correlation to stocks, 1995 to 2025.*

It’s not private equity or real estate. Surprisingly, it’s postwar and contemporary art.

And since 2019, over 70,000 people have started investing in SHARES of artworks featuring legends like Banksy, Basquiat, and Picasso through a platform called Masterworks.

23 exits to date

$1,245,000,000+ invested

Annualized net returns like 17.6%, 17.8%, and 21.5%

My subscribers can SKIP their waitlist and invest in blue-chip art.

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

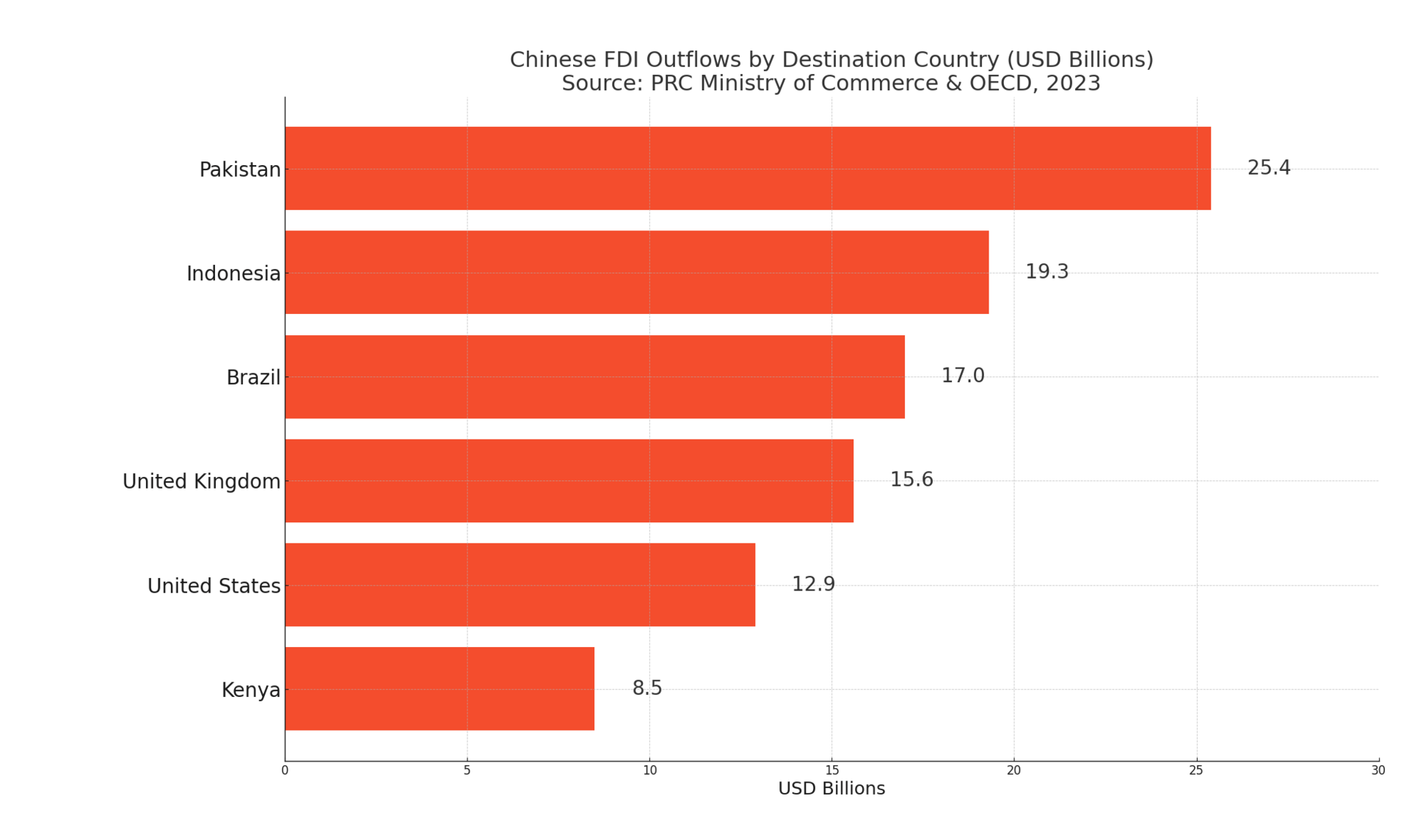

Despite geopolitical tensions, Chinese capital hasn’t stopped flowing—it’s just flowing differently. Chinese sovereign and private funds are now investing through proxies in Southeast Asia, Africa, and Latin America, focusing on energy, logistics, and digital infrastructure.

The Silk Road Fund, China’s quiet state-owned investor, has backed over 30 major projects abroad since 2020—from ports in Kenya to energy grids in Pakistan. Meanwhile, private Chinese wealth is funneled through Singapore-based VCs and trusts.

For investors or expatriates watching policy risks: following the rerouted flow of Chinese capital can offer hints at future diplomatic priorities and soft power plays.

🌏 Fascinating shift: Singapore now handles more Chinese offshore capital than Hong Kong—a sign of changing trust hubs amid global tensions.

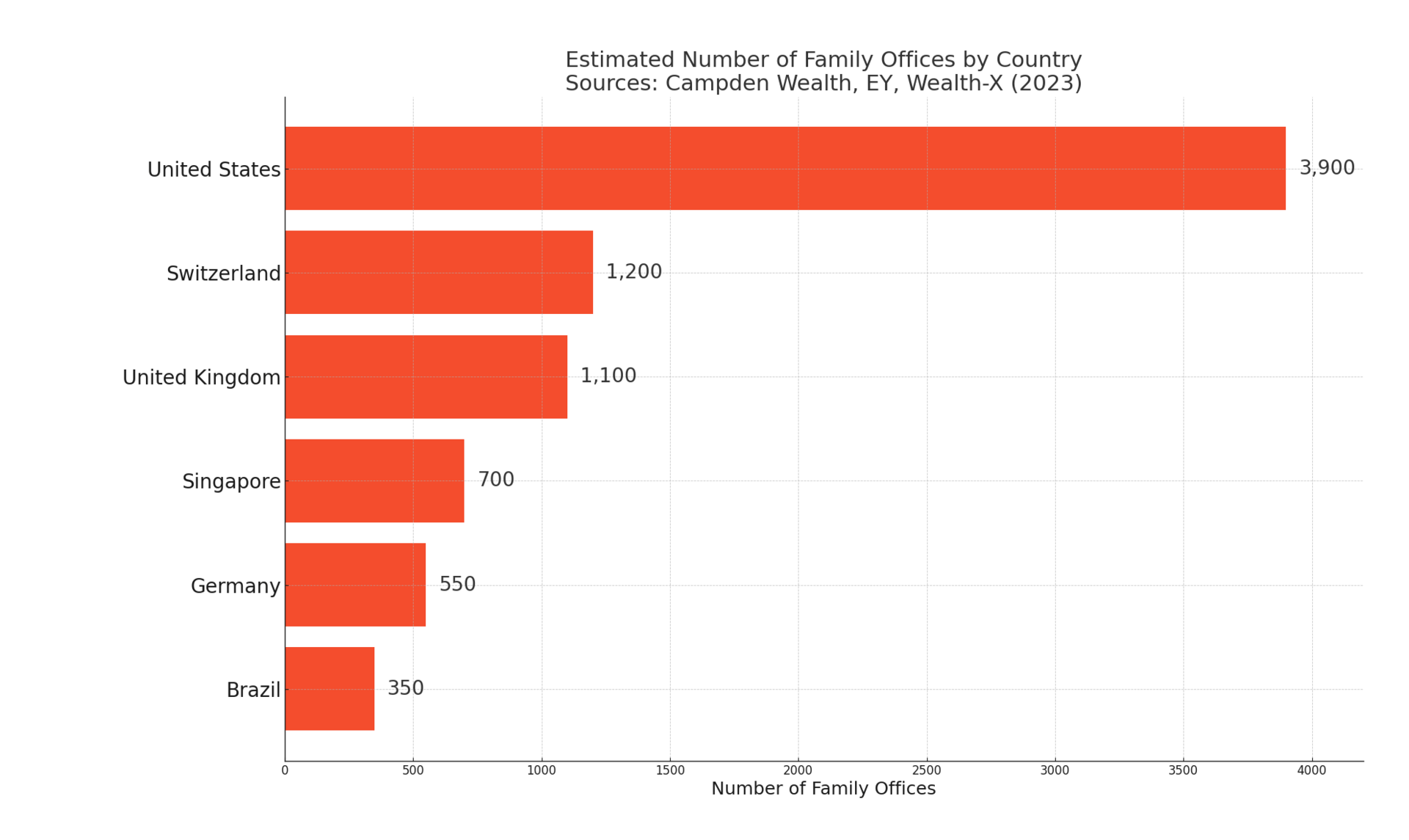

Once passive, family offices are now among the most aggressive private investors in the world—deploying over $8 trillion globally, often with little regulatory disclosure. These aren’t just rich heirs dabbling in stocks. Many now lead funding rounds, buy out distressed assets, or even launch entire tech ecosystems.

From biotech in Israel 🇮🇱 to green hydrogen in Chile 🇨🇱, family offices chase generational returns rather than quarterly profits. Their edge? No LPs, no press releases, no fundraising pressure.

Take the case of a little-known Dutch family office that co-funded a rare-earth mining startup in Greenland. No fanfare, but immense geopolitical implications.

🔍 Insider stat: The number of single-family offices globally has doubled since 2019, with many operating fully under the radar.

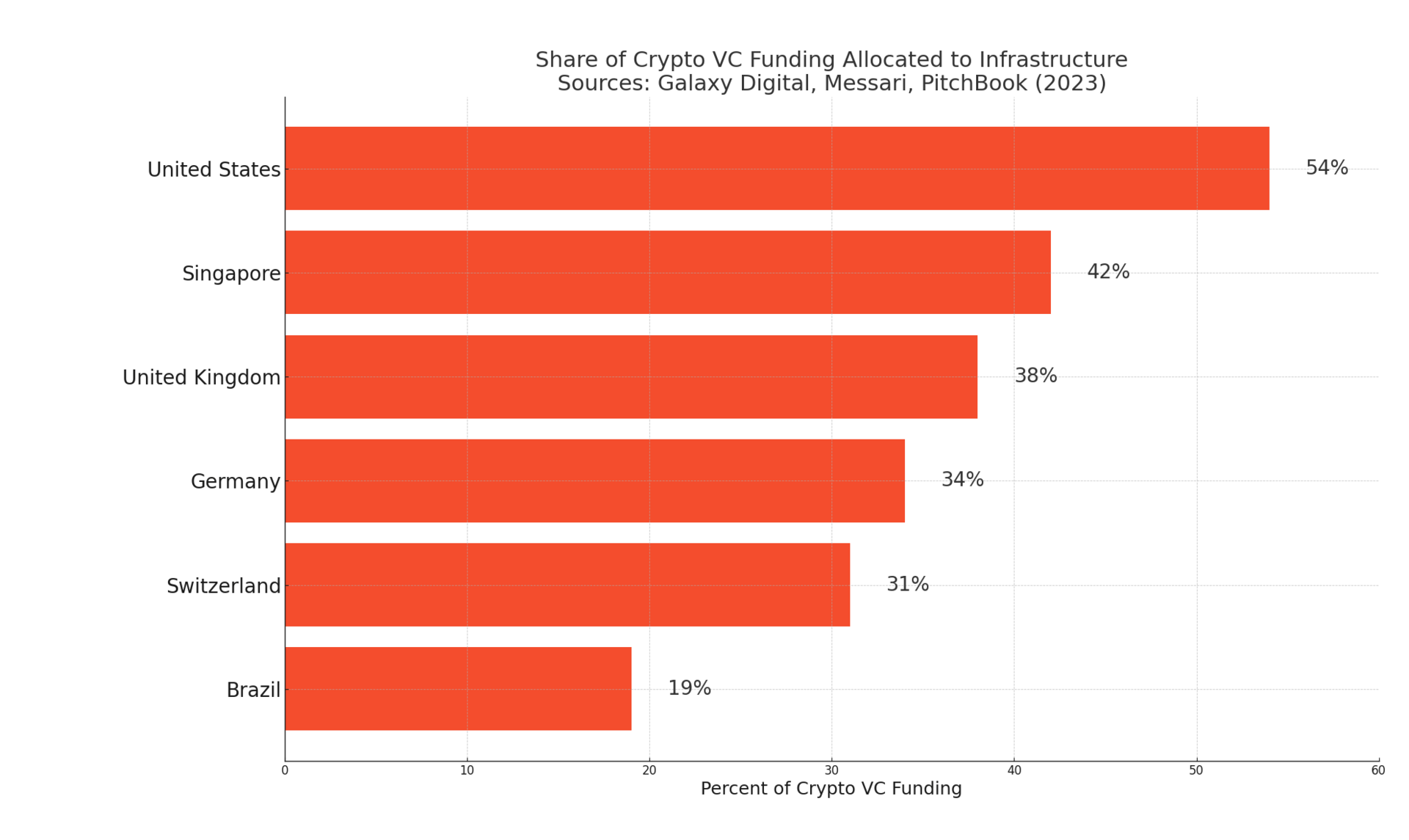

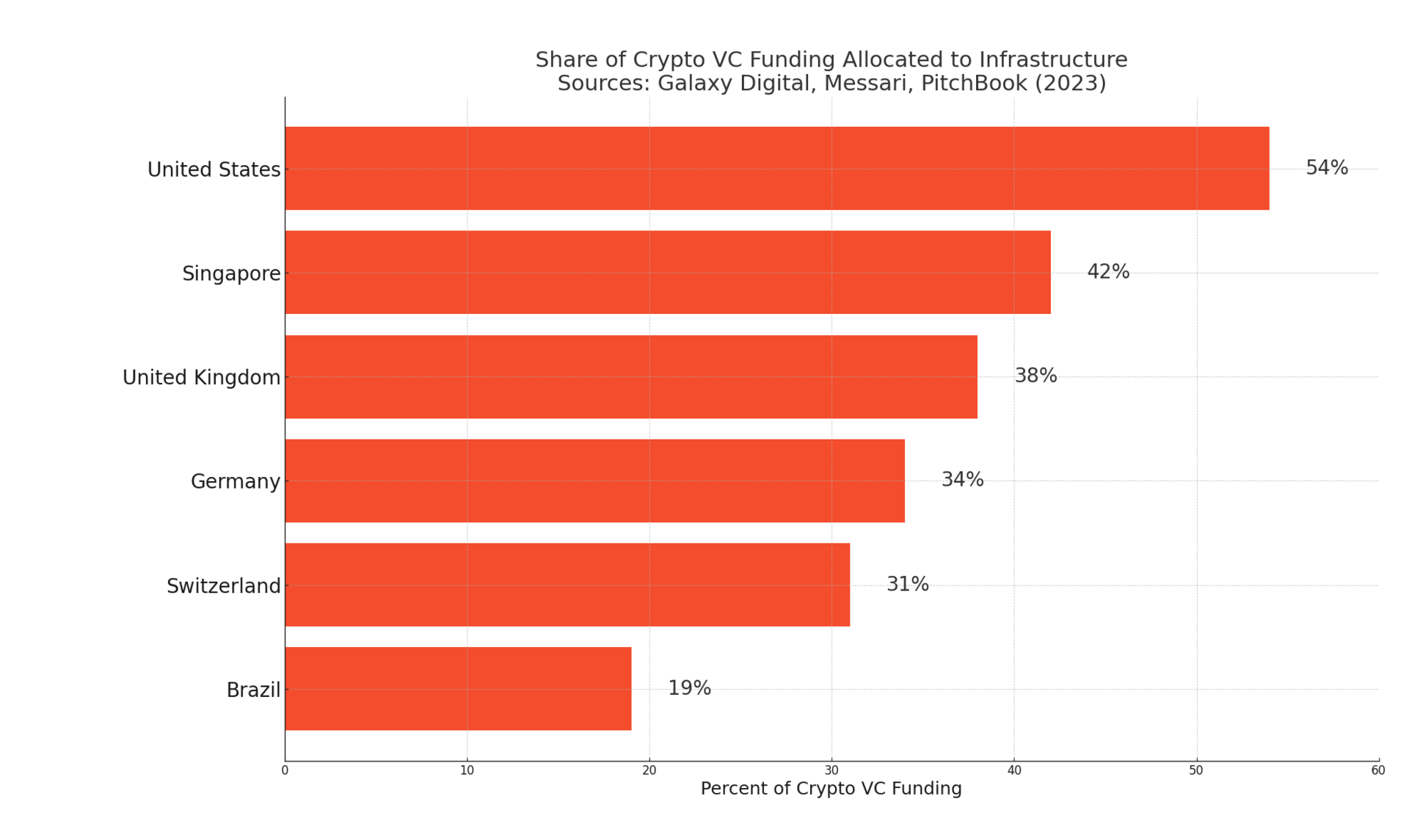

While crypto headlines have cooled, capital hasn’t disappeared—it’s evolved. The new target: blockchain infrastructure—custody services, tokenization rails, compliance tools, and privacy layers. The smart money is building the plumbing, not hyping coins.

Who’s investing? A surprising mix: pension funds, sovereign players, and insurance giants—many using subsidiaries or venture arms to avoid regulatory spotlight.

Notably, a European insurance conglomerate recently led a $120M round in a crypto custody firm—under a generic subsidiary name. The goal? Be ready when institutional adoption goes mainstream.

📉 Hidden trend: Crypto VC funding fell 65% in 2023—but early-stage blockchain infra deals rose 34%, often quietly backed by institutional giants.

Canada flies under the radar—but it quietly controls some of the most active and globally diversified public funds. Entities like CPP Investments and CDPQ don’t just hold domestic stocks. They invest in real estate in Mumbai 🇮🇳, logistics in Mexico 🇲🇽, and renewables in Europe 🇪🇺.

These funds often co-invest with other sovereigns, giving them visibility into global trends without taking political heat. In 2023, CPP took a strategic stake in a Southeast Asian EV battery firm—a bet not just on tech, but on regional dominance.

For readers eyeing Canada for relocation or business: its financial networks stretch far wider than its quiet image suggests.

🍁 Overlooked fact: CPP Investments manages more capital than Russia’s entire sovereign wealth fund—yet rarely makes headlines.

From Arctic pensions to Gulf empires, quiet capital is redrawing the global map—silently but powerfully.

These aren’t just money moves—they’re signals. Of shifting power, rising industries, and the future shape of where we live, work, and invest.

The capital may be quiet. But the implications? Thunderous.

Stay curious. Stay ahead.

Warm regards,

Shane Fulmer

Founder, WorldPopulationReview.com

P.S. Want to sponsor this newsletter? Reach 139,000+ global-minded readers — click here!