- World Population Review Newsletter

- Posts

- These Places Are Dodging the Housing Crisis

These Places Are Dodging the Housing Crisis

From soaring prices to smart policies, discover the new housing map.

Greetings, sharp-eyed seeker of global truths—

The cost of homeownership is skyrocketing. Incomes? Not so much. The result? A worldwide housing crunch reshaping where—and how—we live.

In this edition, we cut through the noise and follow the numbers: Which cities are out of reach? Who’s solving the crisis? And what does it mean for your future, investments, or next big move?

Let’s dive into the data behind the disappearing dream.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

For decades, the price-to-income ratio has served as a clear yardstick for affordability. Historically, a ratio of 3:1 (home prices at three times annual income) was considered healthy. Today? Try 10:1—and sometimes worse.

🏙️ In Hong Kong, the average home costs nearly 19 times the median income. Owning property here borders on fantasy, even for upper-middle-class earners.

🌉 San Francisco and Los Angeles hover around 12:1, making California ground zero for the U.S. housing crisis.

🌁 Surprisingly, Toronto now joins the unaffordable elite, with a ratio exceeding 10:1, driven by immigration-fueled demand and limited supply.

Perspective Shift: In 1990, the average American home cost about 2.8 times household income. Today, it's nearly 6.5x. The global affordability gap isn't closing—it's accelerating.

Renting used to be a flexible, lower-stakes alternative to buying. Not anymore. Across the world, tenants are feeling the squeeze.

🇩🇪 In Berlin, average rents surged 27% in a single year after a rent cap law was overturned—turning stable neighborhoods volatile.

🇦🇺 Sydney renters now spend over 35% of their income on housing—well above the affordability threshold set by the OECD.

🇺🇸 In the U.S., the median rent hit a record $2,050/month, pricing out younger and lower-income households in metros from Phoenix to Miami.

Curious Stat: In 2023, more than half of U.S. renters were considered “rent-burdened”—spending over 30% of their income on rent, a level unseen in modern memory.

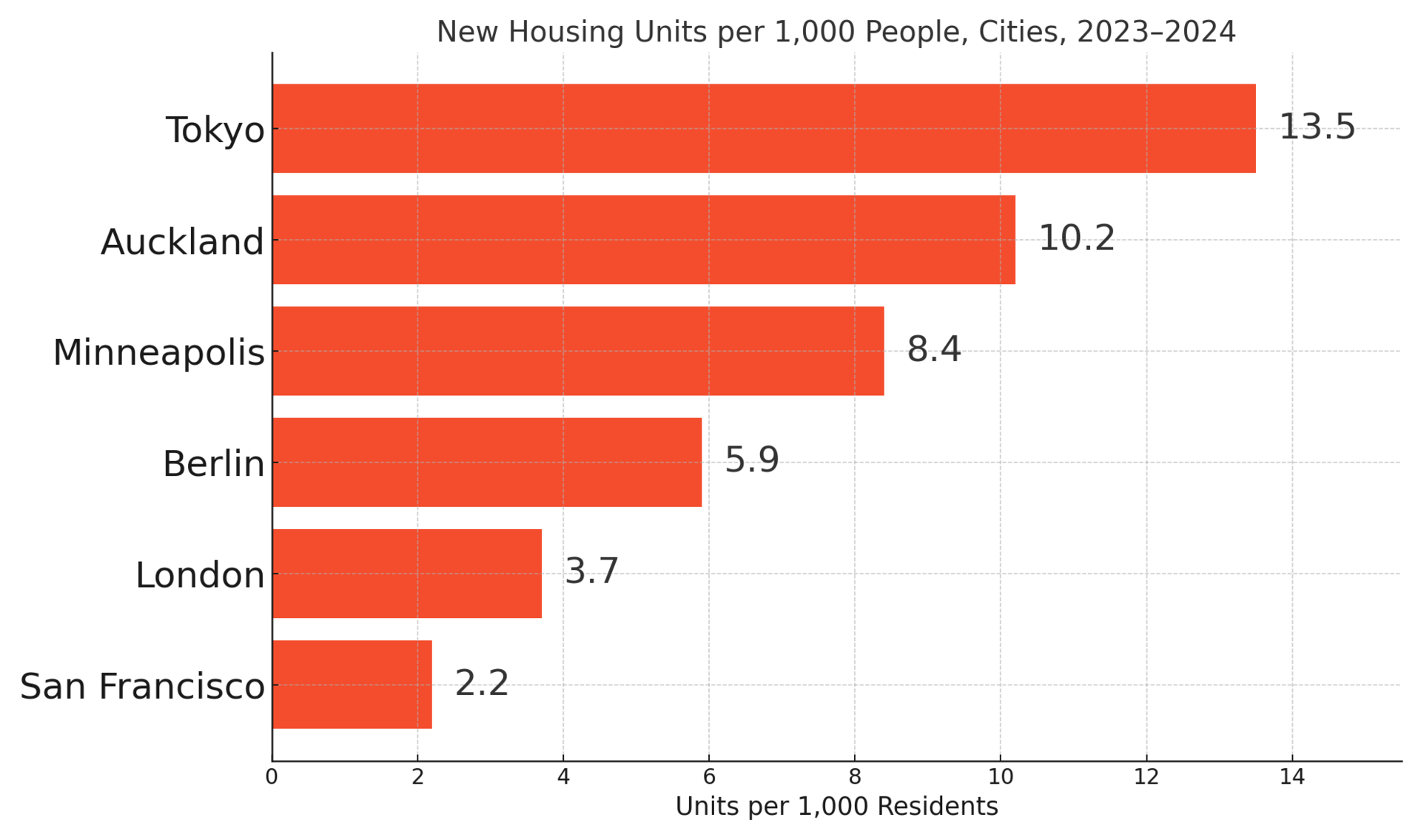

Not every city is standing still. A quiet policy revolution is reshaping how and where we build.

🇯🇵 Tokyo has become a case study in affordability by... building. The city issues more housing permits than any Western capital, maintaining stable prices despite population growth.

🇳🇿 Auckland scrapped single-family zoning in key areas, unlocking thousands of new multi-unit builds and slowly bending the affordability curve.

🇺🇸 In Minneapolis, a landmark decision to ban single-family zoning citywide has already led to a modest rise in duplex and triplex developments—early signs of success.

Insight Worth Noting: In Tokyo, housing supply has outpaced household formation for decades—and as a result, average rents have fallen slightly over the past 20 years.

In much of Europe, homeownership is seen as a cultural legacy. But the rules often make buying harder, not easier.

🇫🇷 In Paris, price controls have done little to cool prices hovering at €10,000 per square meter, while bureaucracy slows new construction to a crawl.

🇸🇪 Stockholm has a decades-long waiting list for rent-controlled apartments, pushing young Swedes into the arms of sky-high secondhand rentals or long stays with parents.

🇨🇭 Zurich offers strong tenant protections—but limited building means the city has one of the tightest rental markets in Europe.

Did You Know? In Germany, the average wait for a subsidized apartment in major cities is now over 6 years.

Despite global trends, a few countries continue to offer hope—affordable housing, livable cities, and smart policy.

🇵🇹 Portugal’s interior towns, like Guarda or Castelo Branco, offer homes for under €100,000—with public programs incentivizing foreign retirees and remote workers.

🇲🇽 In places like Mérida, you can buy a modern home for under $120,000 in a city ranked among the safest in Latin America.

🇵🇱 Poland’s secondary cities, such as Lublin or Rzeszów, offer price-to-income ratios under 5:1 and solid public infrastructure.

Surprising Insight: In Italy’s "€1 homes" program, hundreds of medieval villages have sold properties for a single euro—provided buyers commit to renovation. Some are now tourist gems.

Homeownership was once the cornerstone of financial stability. But for younger generations, the ladder is missing.

📉 In the U.S., homeownership among 25–34-year-olds is down 8% from 2000, despite higher levels of education and dual incomes.

🏘️ In South Korea, rising interest rates and speculative demand have priced many young professionals out of Seoul entirely—leading to a surge in co-living and long-term rentals.

🇬🇧 In the UK, first-time buyers now need 9x their annual salary to purchase in London, up from 3x in the 1990s.

Eye-Opener: The average down payment required to buy a home in San Jose, CA, now exceeds $250,000—a figure well beyond most millennials' reach.

The future of housing affordability will be shaped by three key forces—each with global ripple effects.

🔁 Remote Work: As more jobs go virtual, smaller towns and rural areas could see revitalization—and price pressure.

🏗️ Modular Construction: From 3D-printed homes to prefabs, faster building methods are slashing costs in countries like China and Sweden.

💡 Policy Shifts: Land-use reform is gaining momentum globally, from California to Canada, where local governments are under pressure to legalize denser housing.

Striking Forecast: By 2030, over one-third of the world’s urban population is expected to live in slums or informal housing if affordability trends go unchecked—according to the UN.

From Berlin to Seoul, housing markets are flashing red. But behind the crisis lies opportunity—for those paying attention.

Whether you're scouting your next home, planning a retirement abroad, or simply investing wisely, knowing where affordability is rising or vanishing puts you ahead of the curve.

The dream isn’t dead. It’s just relocated.

Until next time—stay alert, stay informed, and stay one step ahead.

Warm regards,

Shane Fulmer

Founder, WorldPopulationReview.com

P.S. Want to sponsor this newsletter? Reach 126,000+ global-minded readers — click here!