- World Population Review Newsletter

- Posts

- This Wallet Could Replace Your Bank Account

This Wallet Could Replace Your Bank Account

Who's banking on Web3—and who's left holding cash?

Greetings, curious navigator of global change!

What if your phone was your bank—and the bank was gone?

For millions, that’s already reality. For billions more, it’s still out of reach.

This edition dives into the great financial leap: who’s racing ahead with digital wallets and DeFi—and who’s still stuck in cash.

Let’s explore the divide that’s redefining money itself.

The Smartest Free Crypto Event You’ll Join This Year

Curious about crypto but still feeling stuck scrolling endless threads? People who get in early aren’t just lucky—they understand the why, when, and how of crypto.

Join our free 3‑day virtual summit and meet the crypto experts who can help you build out your portfolio. You’ll walk away with smart, actionable insights from analysts, developers, and seasoned crypto investors who’ve created fortunes using smart strategies and deep research.

No hype. No FOMO. Just the clear steps you need to move from intrigued to informed about crypto.

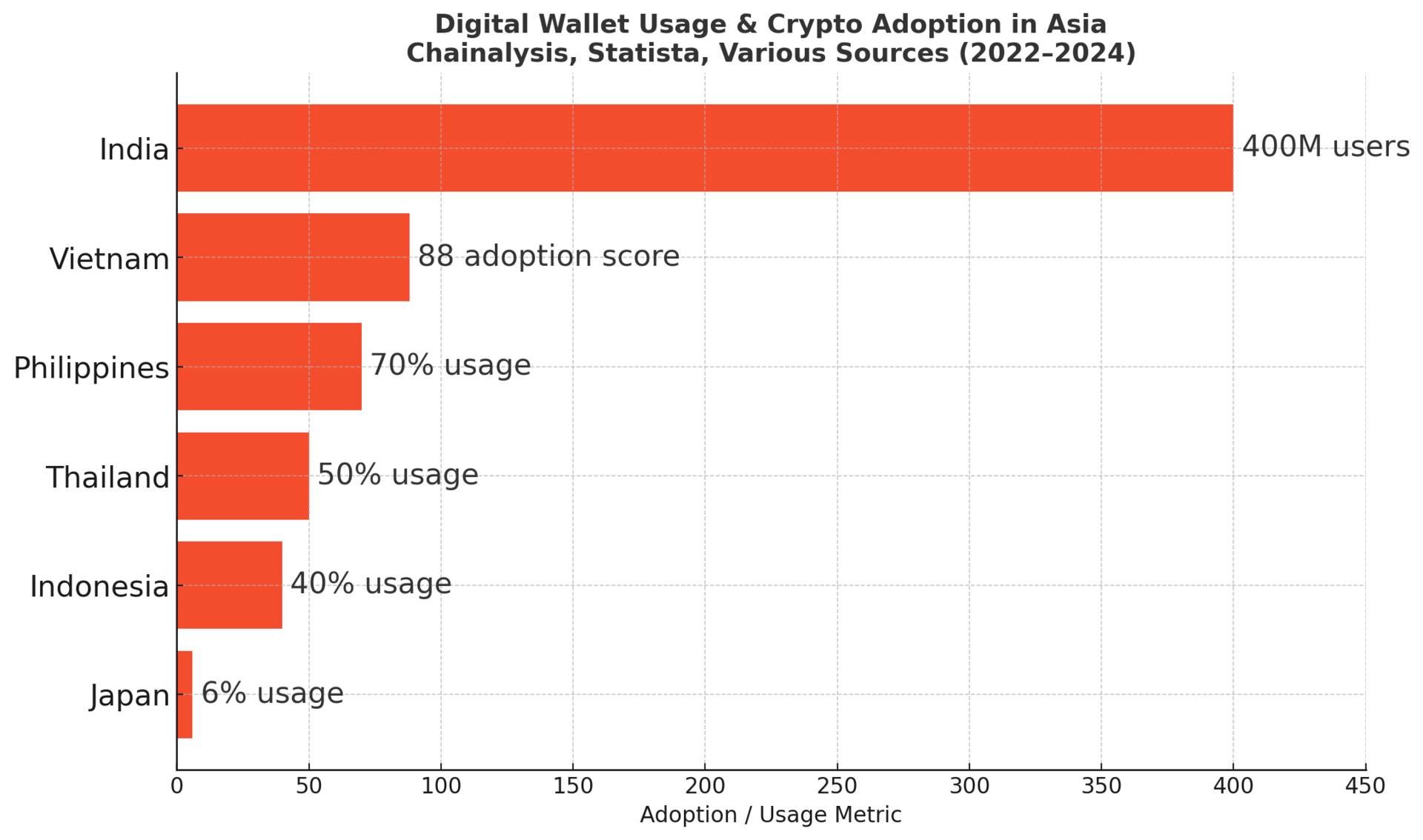

In parts of Asia, mobile wallets are not just digital conveniences—they are lifelines. With many leapfrogging traditional banking, Asia leads the global charge in crypto and digital wallet usage.

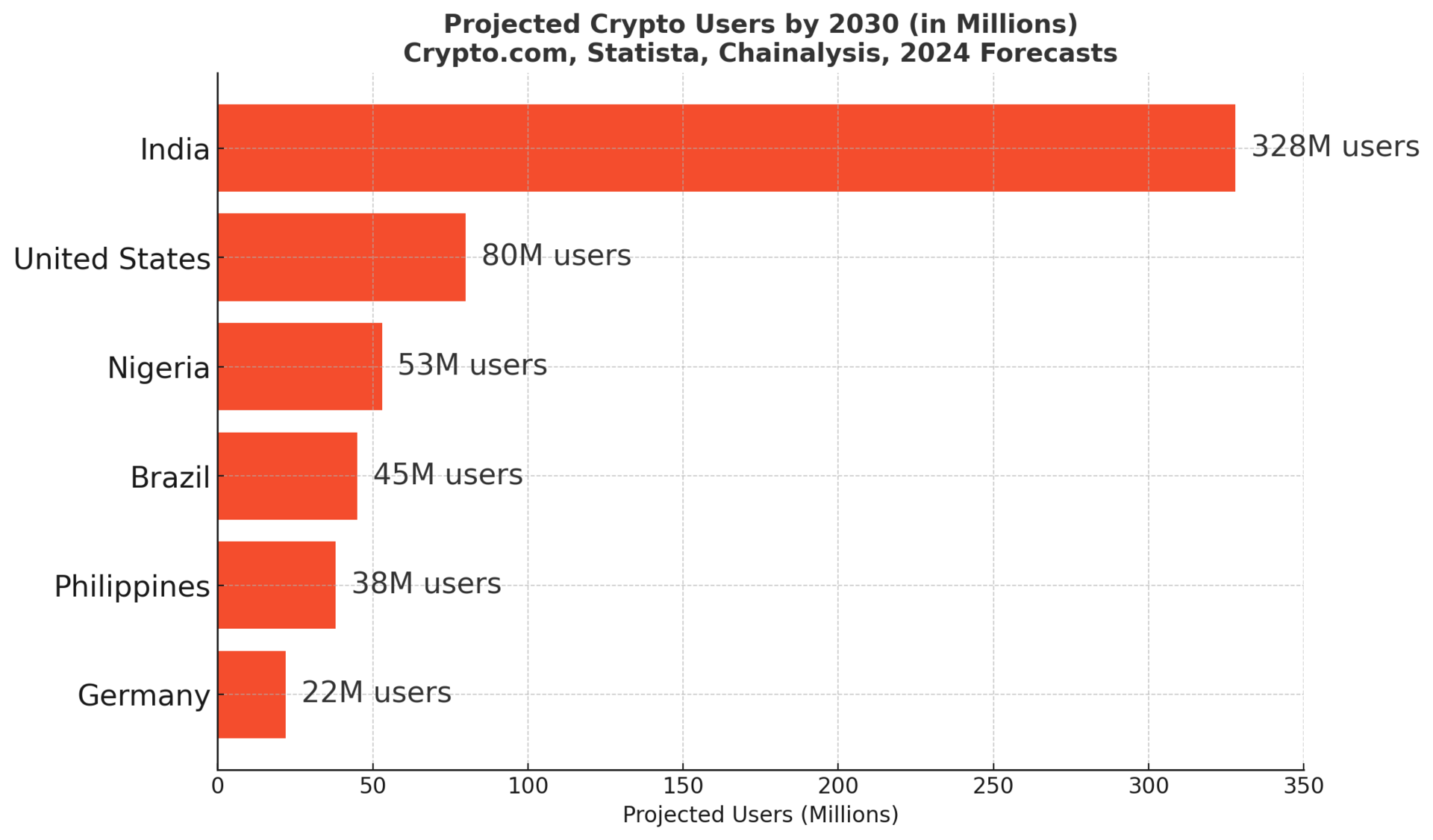

🇮🇳 India has emerged as the world’s top adopter of decentralized finance. Why? Low banking access, a booming tech-savvy youth, and an aggressive push for financial inclusion. Over 400 million Indians use digital wallets—many skipping traditional accounts altogether.

🇵🇭 The Philippines is riding a fintech wave, with nearly 70% of adults using e-wallets like GCash and Maya. Remittances—a $36 billion industry—flow faster and cheaper through blockchain rails.

🇻🇳 Vietnam punches above its weight with high crypto ownership rates and grassroots DeFi usage, driven by inflation concerns and youth enthusiasm.

🔍 Stat to chew on: Vietnam ranks #3 globally in crypto adoption, ahead of the U.S., according to Chainalysis.

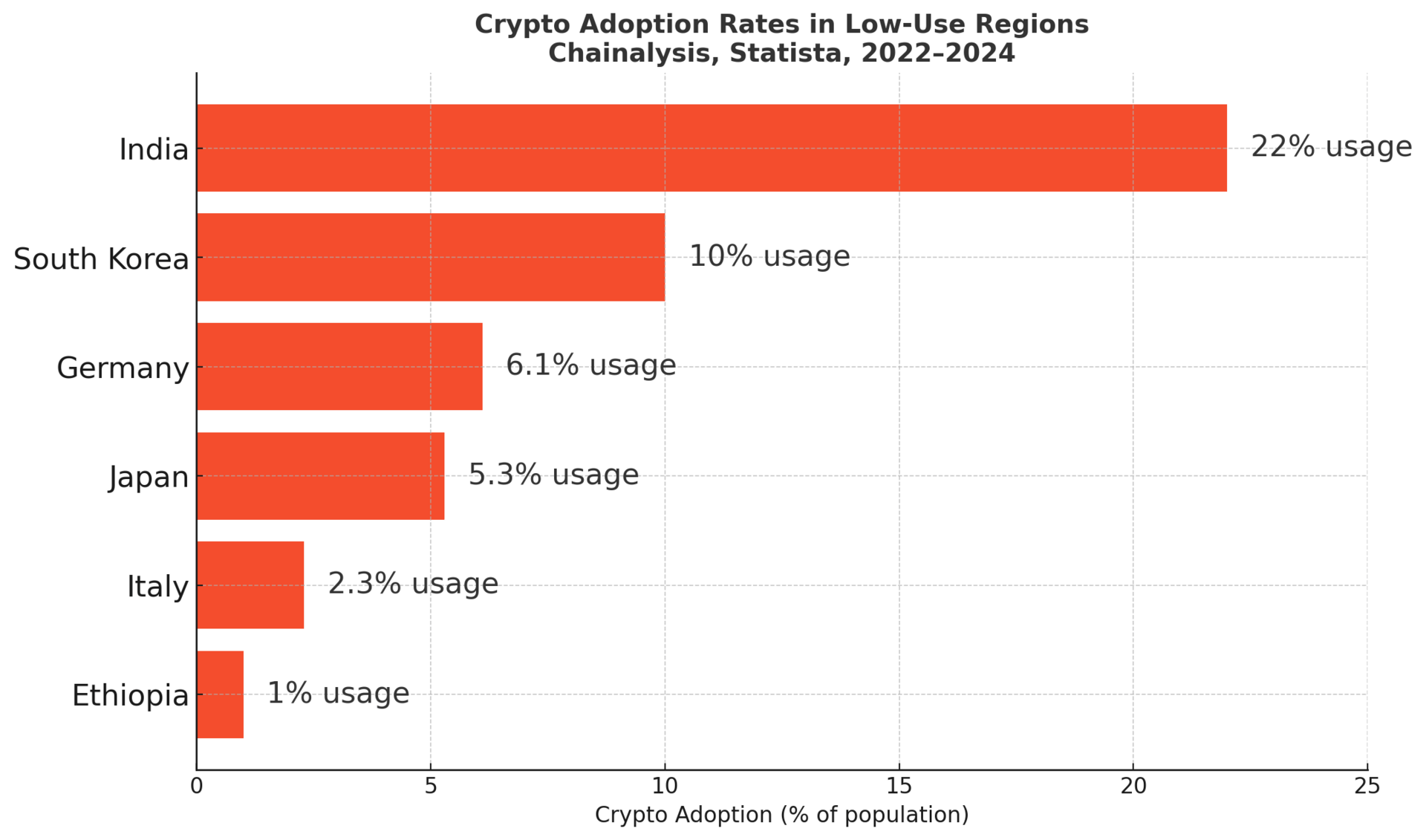

While some regions ride the Web3 wave, others remain in the financial Stone Age—by choice or circumstance.

🇩🇪 Germany offers robust banking but lags in crypto adoption. Regulatory caution and strong trust in legacy banks slow innovation. Only about 6% of Germans own cryptocurrency.

🇯🇵 Japan, despite being the birthplace of Bitcoin’s whitepaper, has embraced digital wallets mainly for yen-based payments. Crypto use is minimal due to conservative financial norms.

🇪🇹 Ethiopia reflects another digital divide. With just 35% of adults having bank accounts and patchy mobile coverage, blockchain finance feels worlds away—though initiatives like Cardano’s ID project hint at long-term change.

💡 Unexpected insight: Japan legalized crypto exchanges early—but still has one of the lowest DeFi usage rates among developed nations.

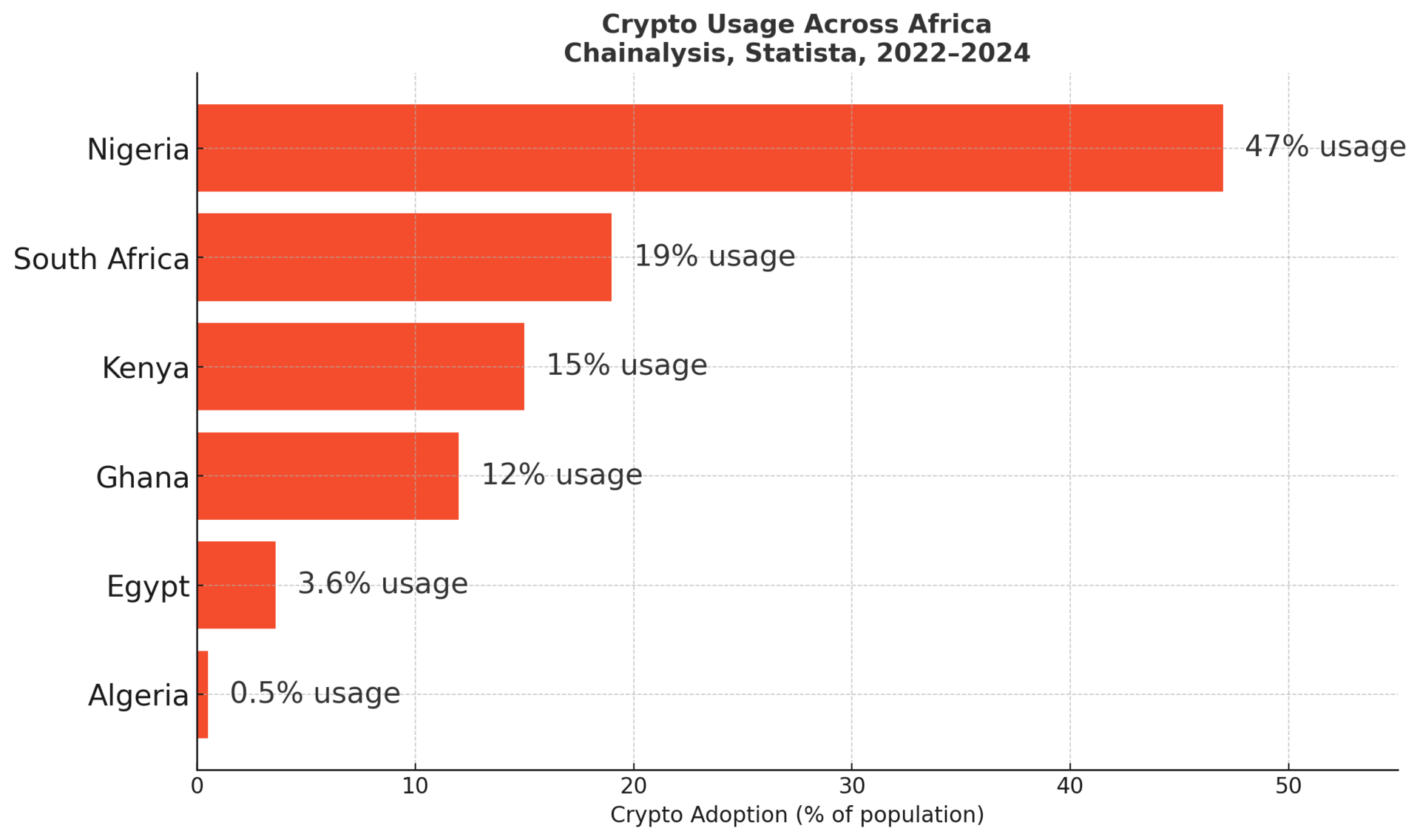

Africa holds a paradox: low bank access, but high mobile penetration. And where there's connectivity, crypto finds a way.

🇳🇬 Nigeria leads Africa in crypto use, with nearly 50% of millennials reporting ownership. Peer-to-peer platforms flourish amid currency instability and bank distrust.

🇰🇪 Kenya, famous for M-Pesa’s mobile money dominance, now experiments with blockchain remittances and DeFi lending for farmers and micro-entrepreneurs.

🇿🇦 South Africa is bridging the gap, with fintech startups offering hybrid crypto-fiat solutions for both urban professionals and informal traders.

🔍 Notable fact: Sub-Saharan Africa saw over $100 billion in crypto transactions in 2022—much of it informal and off-exchange.

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

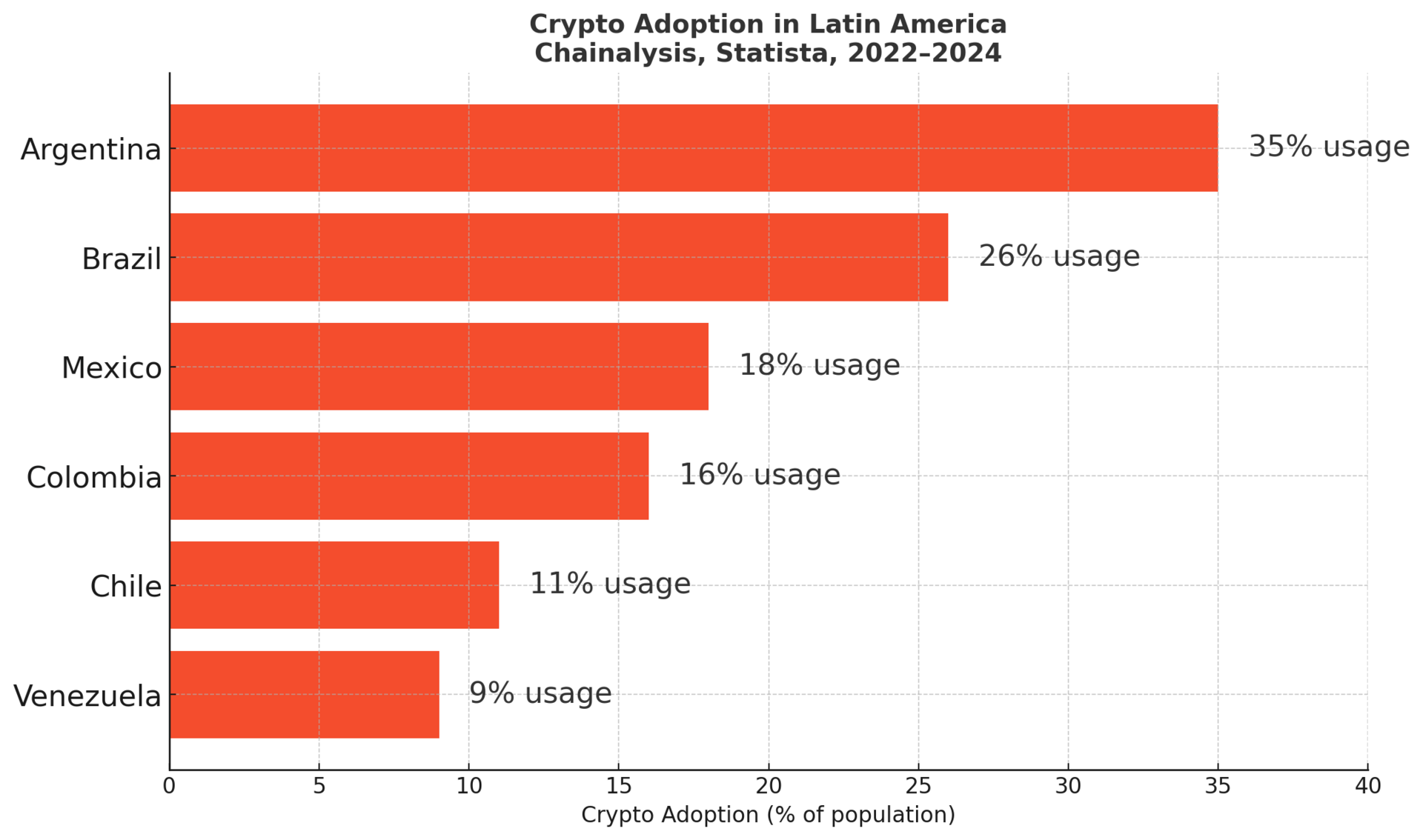

Rising inflation and shaky economies have made digital wallets more than just tech—they’re a hedge against collapse.

🇦🇷 Argentina faces inflation over 140%, making stablecoins like USDT a refuge. Over 1 in 3 young Argentines now use crypto.

🇧🇷 Brazil is building one of the world’s most crypto-integrated financial systems. Its central bank launched Pix, a real-time payment system, and is piloting a digital real.

🇻🇪 Venezuela shows both sides of crypto: it used blockchain for survival amid hyperinflation, yet government-run tokens like the Petro failed to gain trust.

💡 Perspective: In Argentina, some realtors now list homes in USDC—a stablecoin—rather than pesos or dollars.

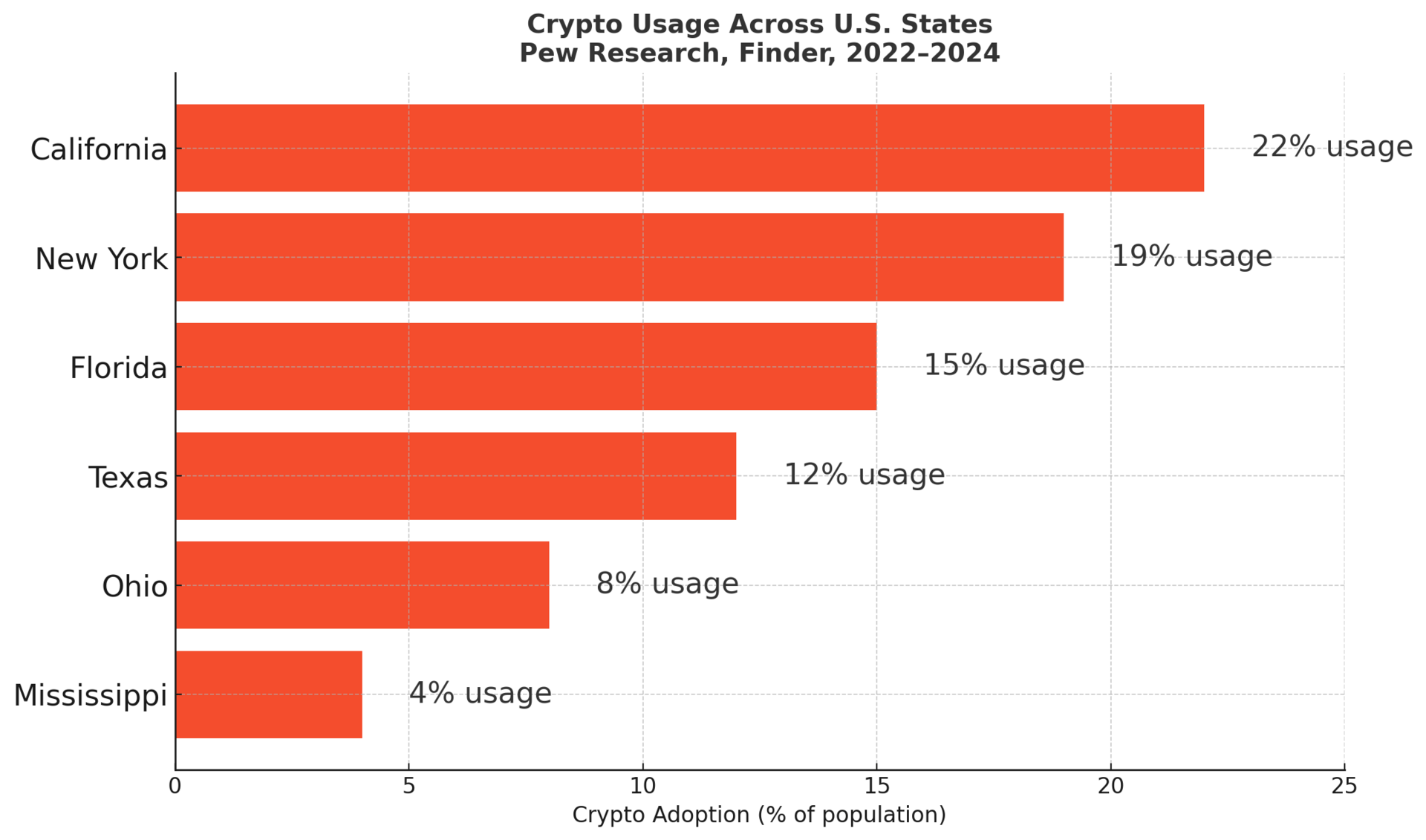

America gave us Bitcoin miners and Silicon Valley's blockchain bonanza—but wallet adoption remains uneven.

✅ Urban tech hubs like San Francisco and New York embrace crypto wallets for everything from investing to paying freelancers.

🚫 Meanwhile, in underbanked rural areas, lack of digital infrastructure means limited access—even as Web3 tools could help the most.

⚖️ Legal limbo doesn’t help. U.S. regulators still treat DeFi with suspicion, creating confusion that stifles mainstream adoption.

🔍 Fascinating forecast: Despite the hurdles, U.S. crypto users are expected to reach 50 million by 2026—about 15% of the population.

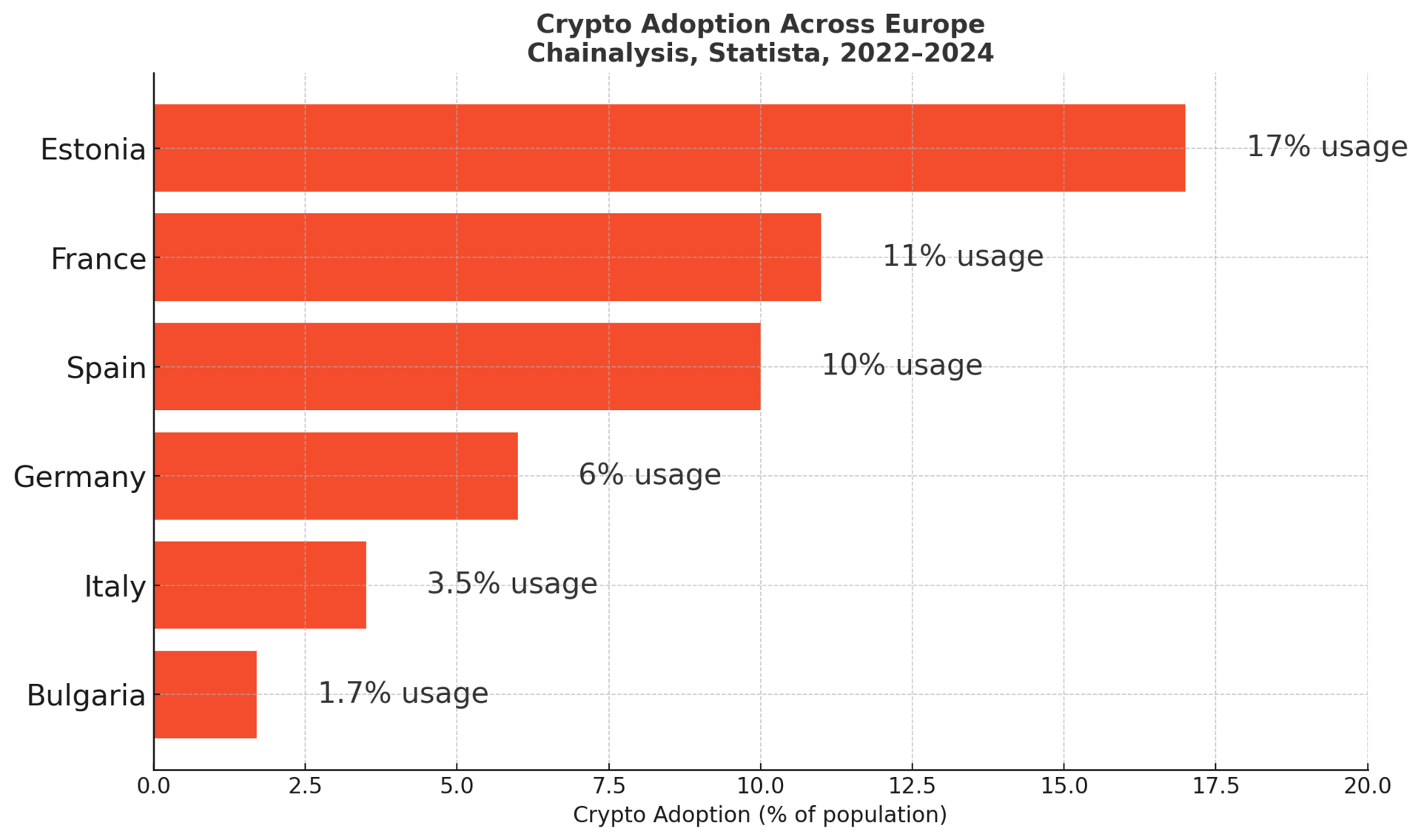

Europe has the tools—but also the bureaucracy. Adoption is slow and cautious.

🇫🇷 France is seeing rising wallet use, especially among Gen Z investors, yet the government prioritizes strict oversight via the EU’s MiCA regulations.

🇪🇸 Spain launched crypto taxation frameworks and is integrating digital IDs into wallet infrastructure. But friction remains.

🇪🇪 Estonia, however, stands apart. This digital-first nation was one of the earliest to license crypto businesses and is now exploring blockchain for public services.

💡 Little-known move: The EU’s MiCA regulation (Markets in Crypto-Assets) will require crypto firms to hold reserves and protect user wallets—potentially stifling innovation but enhancing consumer safety.

Web3 wallets aren’t just apps. They’re gateways to a new financial system—decentralized, programmable, and borderless.

🌍 Emerging economies are driving real-world crypto use, not speculative trading. In many places, DeFi is more about survival than speculation.

💼 Institutional players like Visa and Mastercard are testing blockchain-based payment rails, while central banks explore CBDCs (Central Bank Digital Currencies) as a bridge between crypto and fiat.

🛠️ Infrastructure remains the bottleneck. Without reliable internet, electricity, and legal clarity, many regions remain on the sidelines.

🔍 Bold prediction: By 2030, over 1 billion people could be using blockchain wallets—either by choice or necessity.

Digital wallets are redrawing the rules of who gets to earn, save, and grow wealth.

As money goes borderless, the real question isn’t who logs in first—but who gets left out. Follow the wallets, and you’ll see where the future is headed.

Stay sharp. The next economy won’t wait.

Warm regards,

Shane Fulmer

Founder, WorldPopulationReview.com

P.S. Want to sponsor this newsletter? Reach 136,000+ global-minded readers — click here!