- World Population Review Newsletter

- Posts

- Vacant Cities, Vanishing People: What’s Going On?

Vacant Cities, Vanishing People: What’s Going On?

Inside the global surge of ghost towns, housing gluts, and why it matters.

Skylines rise. Populations shrink. Millions of homes now sit empty.

From silent suburbs to abandoned villages, something deeper is unfolding.

What do empty homes reveal about your future—and the world’s? Let’s dive in and find out…

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

China’s cities once symbolized unstoppable growth. But now, tens of millions of newly built homes sit unoccupied. These "ghost cities"—like Kangbashi in Ordos or parts of Tianducheng—were constructed for a future that never came.

Why? A blend of speculative investment, shrinking birth rates, and rapid urban migration from rural zones created artificial demand. Developers built cities before people arrived—expecting the masses to follow. They didn’t.

🇨🇳 China now has enough vacant homes to house 1.4 billion people—its entire population. That’s nearly 50 million empty units.

Investor Insight: Property in China once seemed like a one-way bet. But today, domestic buyers are skittish, foreign investors are wary, and prices are wobbling. If you're considering investment abroad, understand that an empty skyline may reflect long-term demand issues—not opportunity.

🔍 Unexpected twist: In some ghost cities, property prices remain high—because locals see homes more as financial assets than places to live.

You’d think that in a country with a housing affordability crisis, every home would be occupied. But in the U.S., over 16 million homes sit vacant, even as millions struggle to buy or rent.

Why the disconnect? Some properties are seasonal homes, others sit in transitioning neighborhoods, and a surprising number are owned by investors sitting on idle assets, waiting for prices to rise. Meanwhile, population decline in some rural and post-industrial towns has turned once-thriving communities into modern-day ghost towns.

🗽 States with the highest vacancy rates? Vermont (22.6%), Maine (22%), and Alaska (20.2%)—largely due to vacation homes.

Perspective Shift: Not all empty homes are signs of decay. Some are speculative holdings. But in aging or shrinking towns, they reflect a deeper economic erosion—and a cautionary tale for those eyeing real estate as a retirement investment.

📉 Curious stat: There are more vacant homes in the U.S. than there are homeless people by a ratio of 13 to 1.

Japan is ground zero for demographic decline. As birth rates fall and the elderly population rises, rural villages are fading from the map.

These abandoned homes—called "akiya"—are so plentiful that local governments have created "akiya banks" to give them away or sell them for $1.

🇯🇵 Roughly 13% of all homes in Japan are vacant. In some regions, that number exceeds 20%.

Why it matters: Japan’s case is a sneak preview of what’s coming for other aging nations. Investors and retirees drawn to Japan’s charm should keep in mind: Some of these homes come with complications—ownership rights, repair costs, and even ghost stories.

🎌 Surprising detail: One reason homes are left empty in Japan? Cultural taboos. If someone died in a home (especially a suicide), it may become functionally unmarketable.

Across Europe, postcard-perfect towns are emptying out. The culprit? A mix of aging populations, youth migration to cities, and rising living costs.

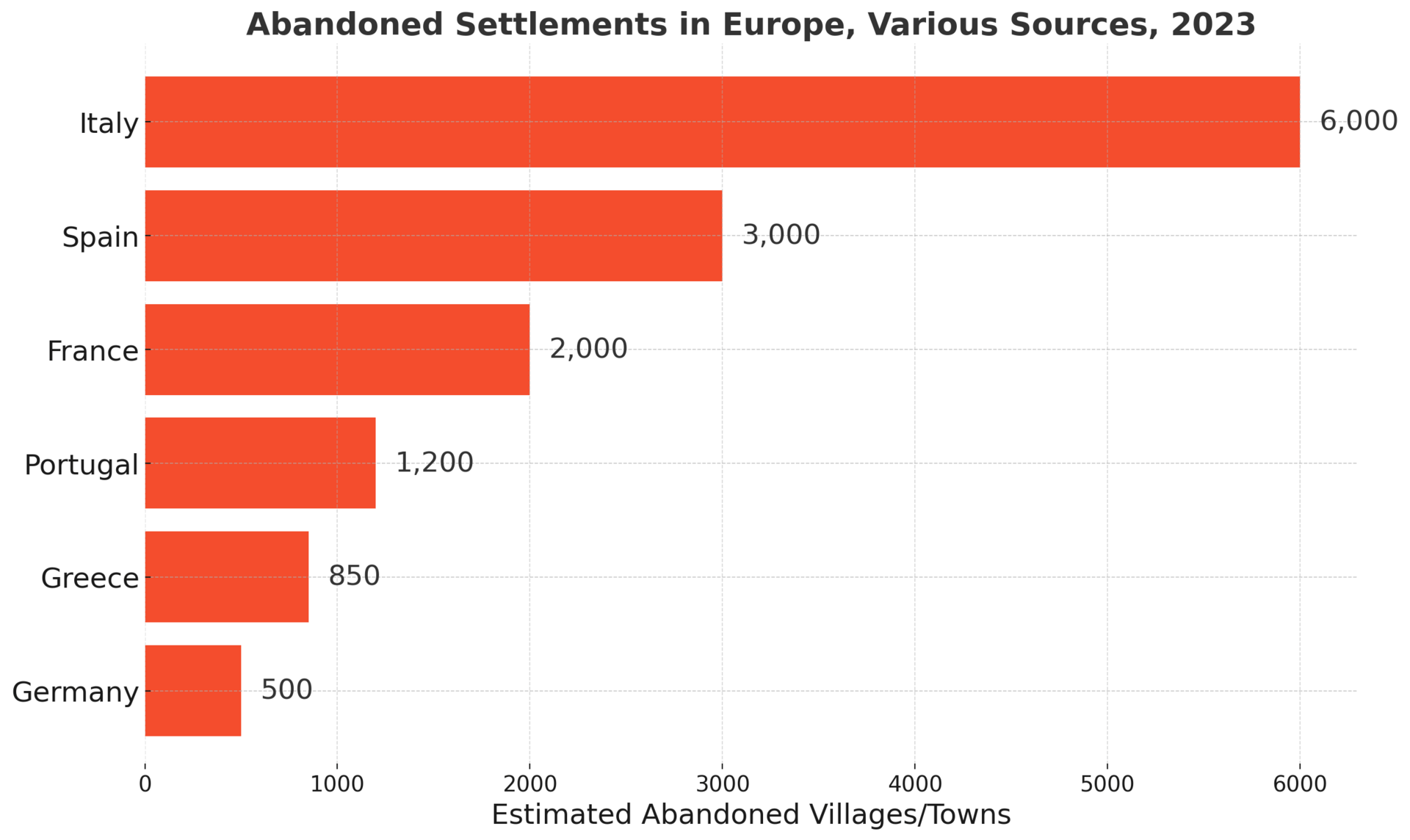

🇮🇹 In Italy, over 6,000 villages face extinction. Many now offer homes for €1, hoping to revive local economies.

🇪🇸 Spain has more than 3,000 ghost towns, largely in its rural heartland—victims of agricultural decline and urban drift.

🇵🇹 Portugal’s countryside suffers a similar fate, with thousands of derelict stone homes amid spectacular landscapes.

Why it’s worth your attention: While the idea of buying a home in Tuscany for a euro is seductive, these come with legal red tape, renovation requirements, and in many cases—no local infrastructure.

🏡 Fun twist: Some towns are seeing a surprising mini-boom—remote workers from the U.S. and Northern Europe snapping up fixer-uppers in the post-COVID exodus from cities.

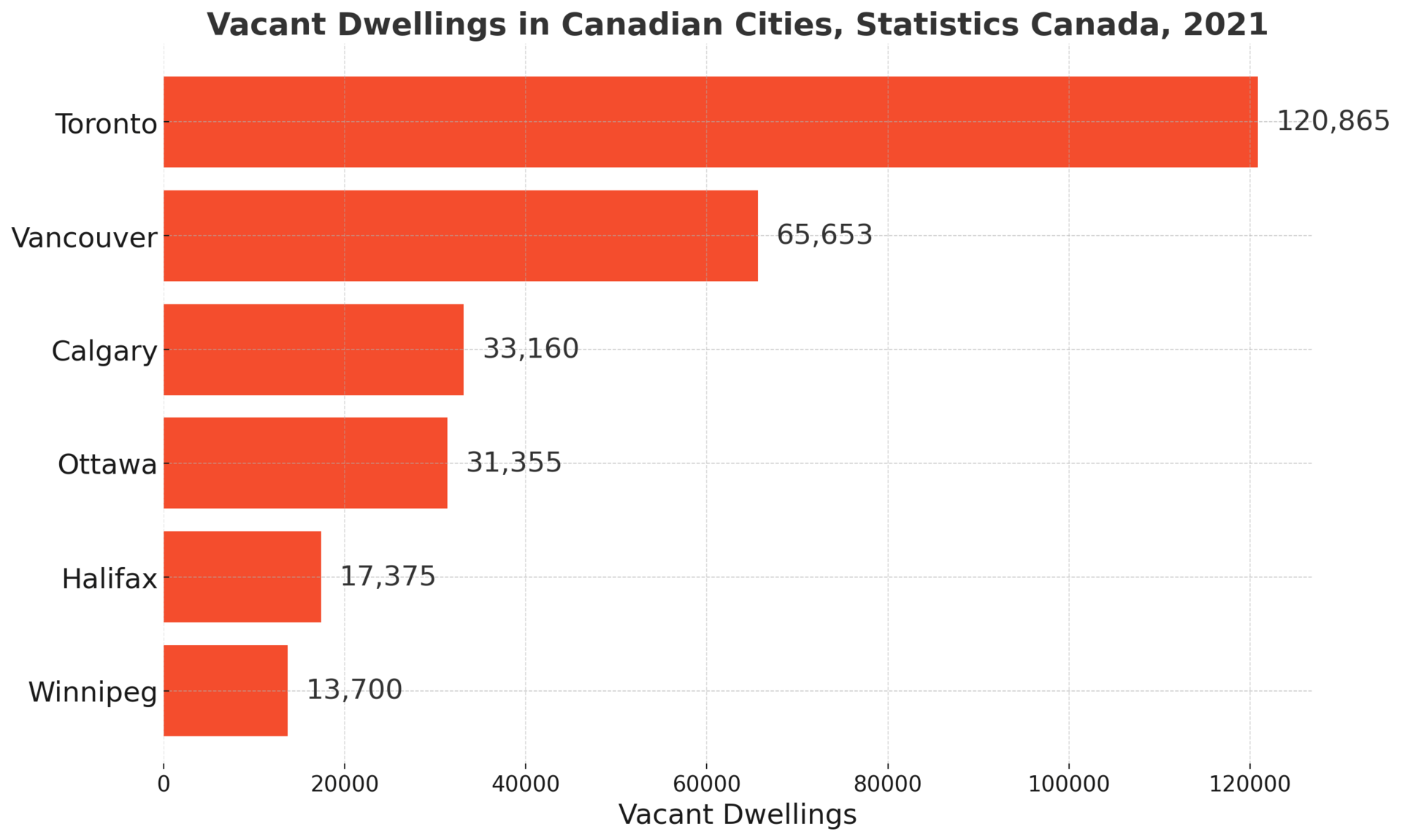

Canada is building homes at a record pace. But in some cities, lights remain off at night—not because people can’t afford homes, but because they’re not living in them.

Vancouver and Toronto face an ironic trend: luxury condos bought as investment properties, left vacant for years.

The government has responded with “vacancy taxes”—targeting absentee owners to force properties into the rental market.

🇨🇦 In 2021, over 1.3 million Canadian homes were empty or temporarily occupied—about 8.7% of the total housing stock.

Real-world impact: In cities where real estate is already unaffordable, ghost units distort supply and drive prices up. It’s a stark reminder that housing isn’t just shelter—it’s currency.

🔍 Fascinating move: Some provinces are now barring foreign homebuyers altogether, hoping to cool speculative heat.

America’s industrial heartland—once the engine of the world—now houses some of its most underpopulated cities.

📉 Detroit, Cleveland, Buffalo, and St. Louis have seen sustained population decline for decades. Abandoned homes rot in place. Services wither. Tax bases erode.

In Detroit, over 30,000 properties are vacant and owned by the city. Demolition programs have been underway for years.

But there’s also rebirth.

🎨 Artists, entrepreneurs, and digital nomads are reclaiming space, turning old homes into studios, offices, or homes for under $10,000.

Tip for the bold: If you're considering low-cost housing or creative investment, cities like Buffalo and Pittsburgh may be undervalued—if you know how to assess local momentum.

🏚️ Haunting fact: In some Detroit neighborhoods, entire blocks have fewer than five occupied homes.

Vacant homes are more than wasted space. They’re symptoms of bigger forces: aging populations, migration trends, speculative finance, climate shifts, and technological disruption.

In some regions, vacancy is an economic danger. In others, it’s an opportunity to rethink housing—offering affordable entry points, repurposing spaces for community use, or housing displaced populations.

🧠 Trend to watch:

Climate change could reverse population flows—abandoned northern towns may become viable again.

AI and remote work could redistribute population density, breathing life into forgotten places.

What this means for you: Whether you’re eyeing your next home, your next investment, or your next great adventure—don’t just look where the crowds are going. Sometimes, the smartest move is to look where they’ve left.

📊 Foresight stat: By 2050, over 1 in 4 homes in Japan and South Korea could be vacant—mirroring the future of other aging nations.

From Tokyo to Toledo, empty homes are more than urban oddities. They’re signals in the noise—clues to where the world is shrinking, growing, or shifting altogether.

Understanding these patterns gives you a strategic edge—whether you’re planning retirement abroad, buying property, or simply navigating an uncertain future.

In every hollow home, there's a story—and perhaps, a door waiting to be opened.

Warm regards,

Shane Fulmer

Founder, WorldPopulationReview.com

P.S. Want to sponsor this newsletter? Reach 127,000+ global-minded readers — click here!