- World Population Review Newsletter

- Posts

- Why Cash Is Dying Faster Than Anyone Expected

Why Cash Is Dying Faster Than Anyone Expected

How countries race toward a digital-payment future.

Greetings, curious navigator of shifting economies—

Cash is disappearing. Not everywhere, and not all at once. But the world is changing fast—one tap, one scan, one digital wallet at a time.

This edition takes you inside the global sprint (and stumble) toward cashless living. Who’s nearly there? Who’s pushing back? And what does it all mean for your money, freedom, and future choices?

Let’s dive in.

The daily health habit you’ll actually stick with…

This time of year, it’s SO hard to stay in control of your health.

Holiday travel (and meals!), big family gatherings, dark and cold days, it’s easy to skip that workout, sleep in later than you should, or have just one more cookie.

That’s why you need a daily health habit that’s easy to stick with.

Meet AG1: With just one quick scoop every morning, you’ll get over 75 ingredients that help support your immune health, gut health, energy, and close nutrient gaps in your diet.

Right now is the best time to get started - with every new subscription, they are giving away $126 in free gifts for the holidays.

Give AG1 a try today and take control of your health this holiday season.

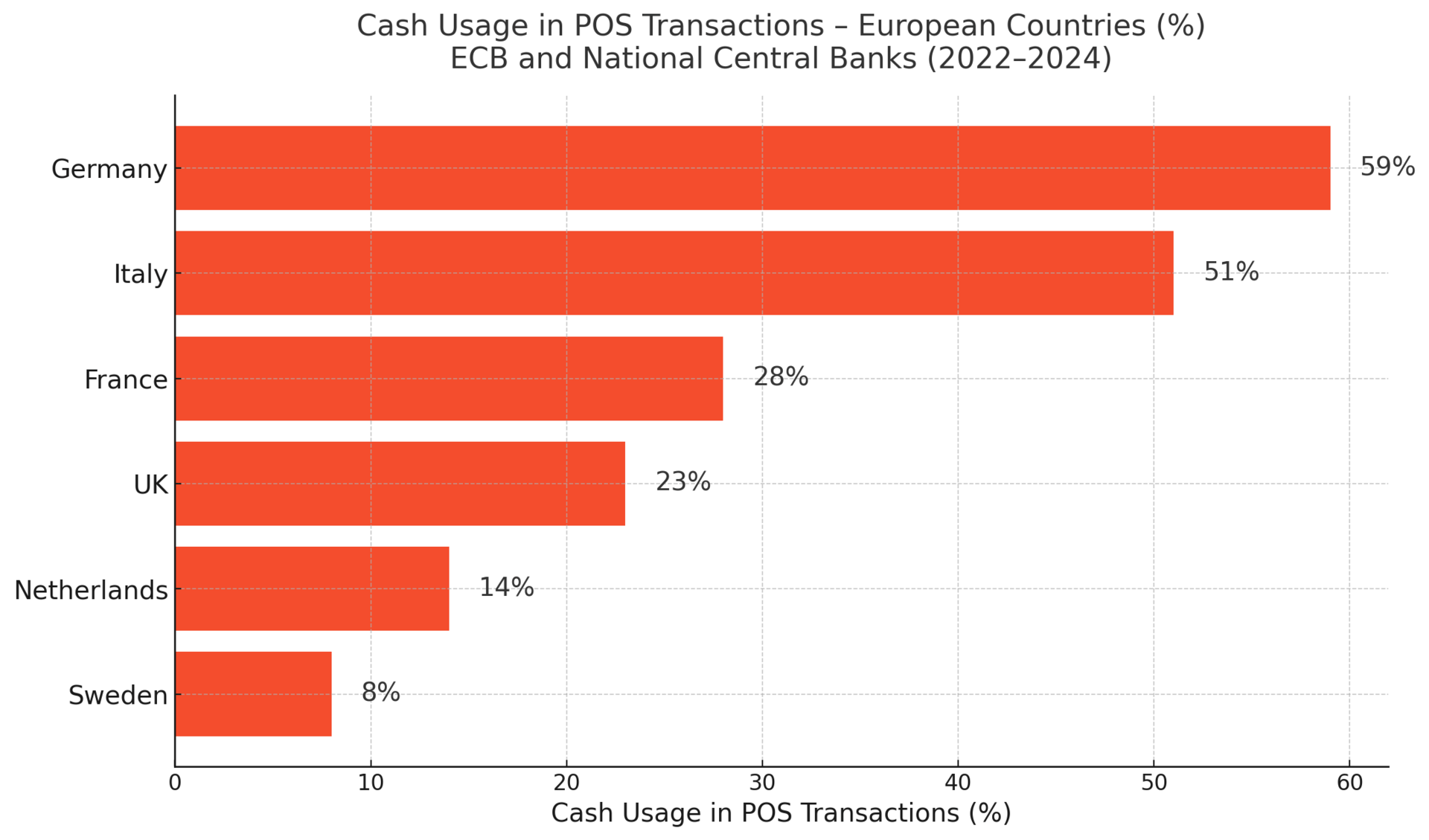

Walk into a café in Stockholm, and you might see a sign: “No cash accepted.” This isn’t rare—it’s the norm.

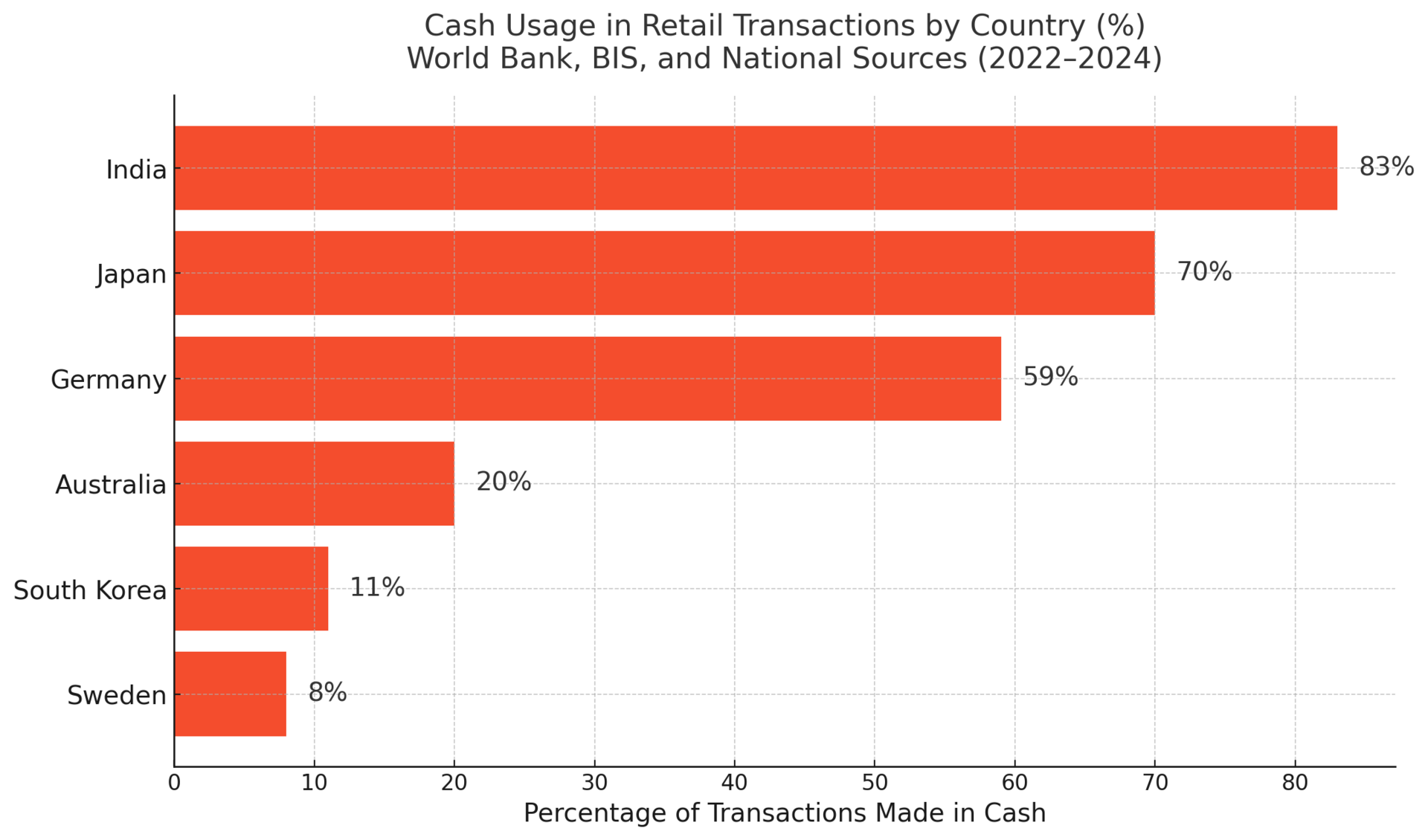

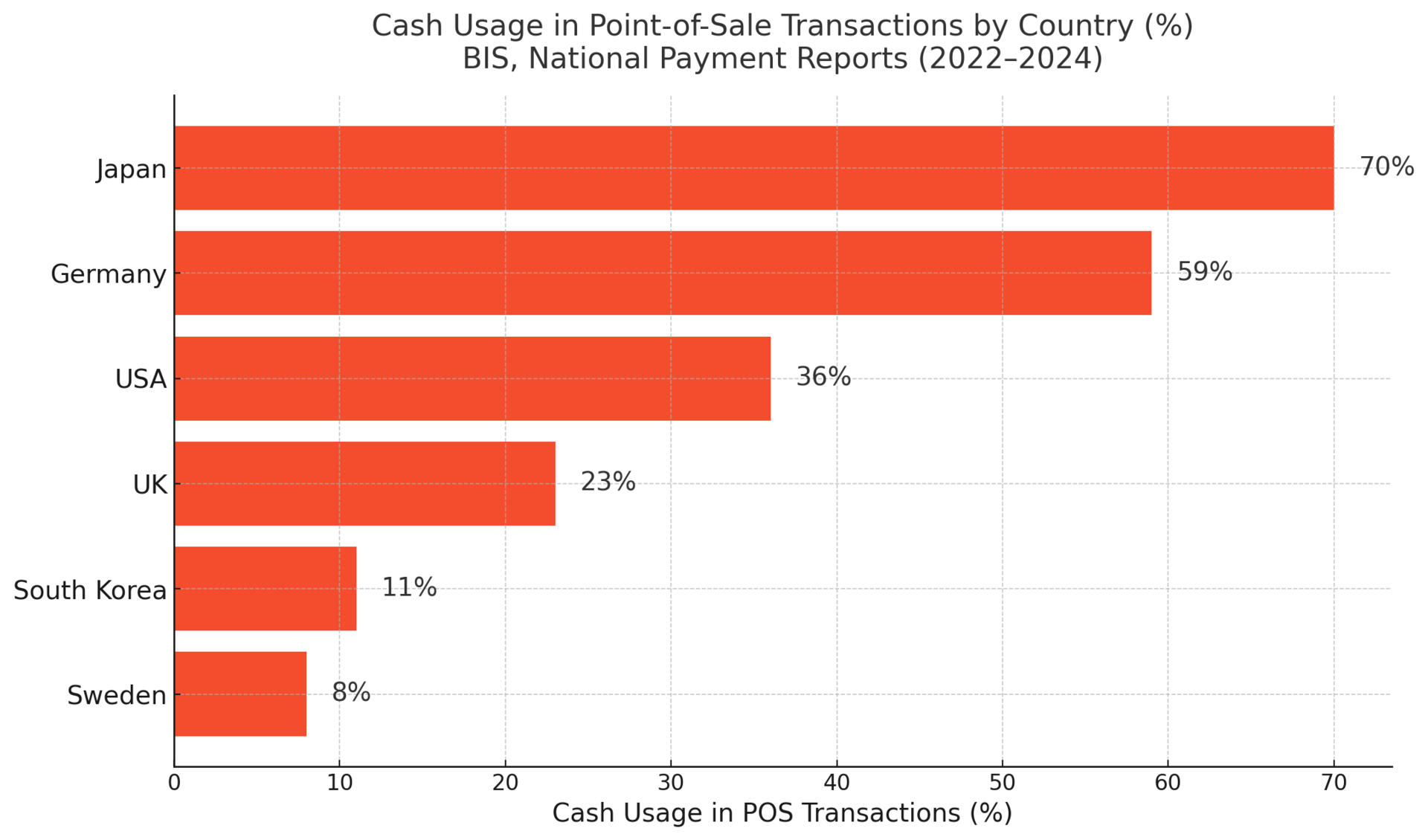

Sweden is arguably the world’s most cashless country. In 2023, fewer than 8% of transactions were cash-based. Even street performers take Swish—a mobile payment app used by over 70% of the population.

The transition is largely cultural. Swedes trust banks, digital systems, and government regulation. But critics worry: what happens to the elderly, refugees, or the tech-averse?

🧠 Interesting stat: Over 98% of Swedes have access to both a mobile device and bank account—making nationwide digital adoption uniquely possible.

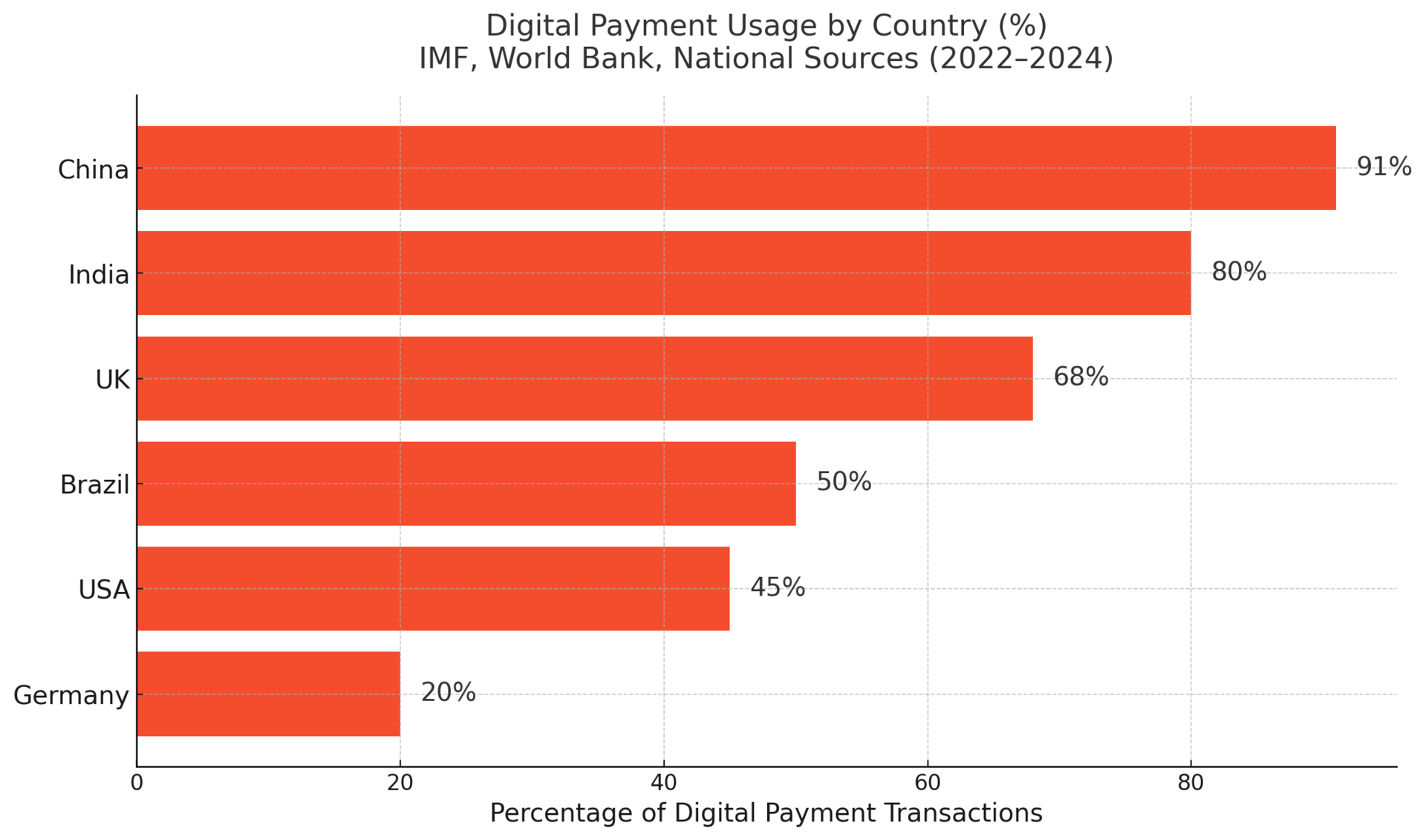

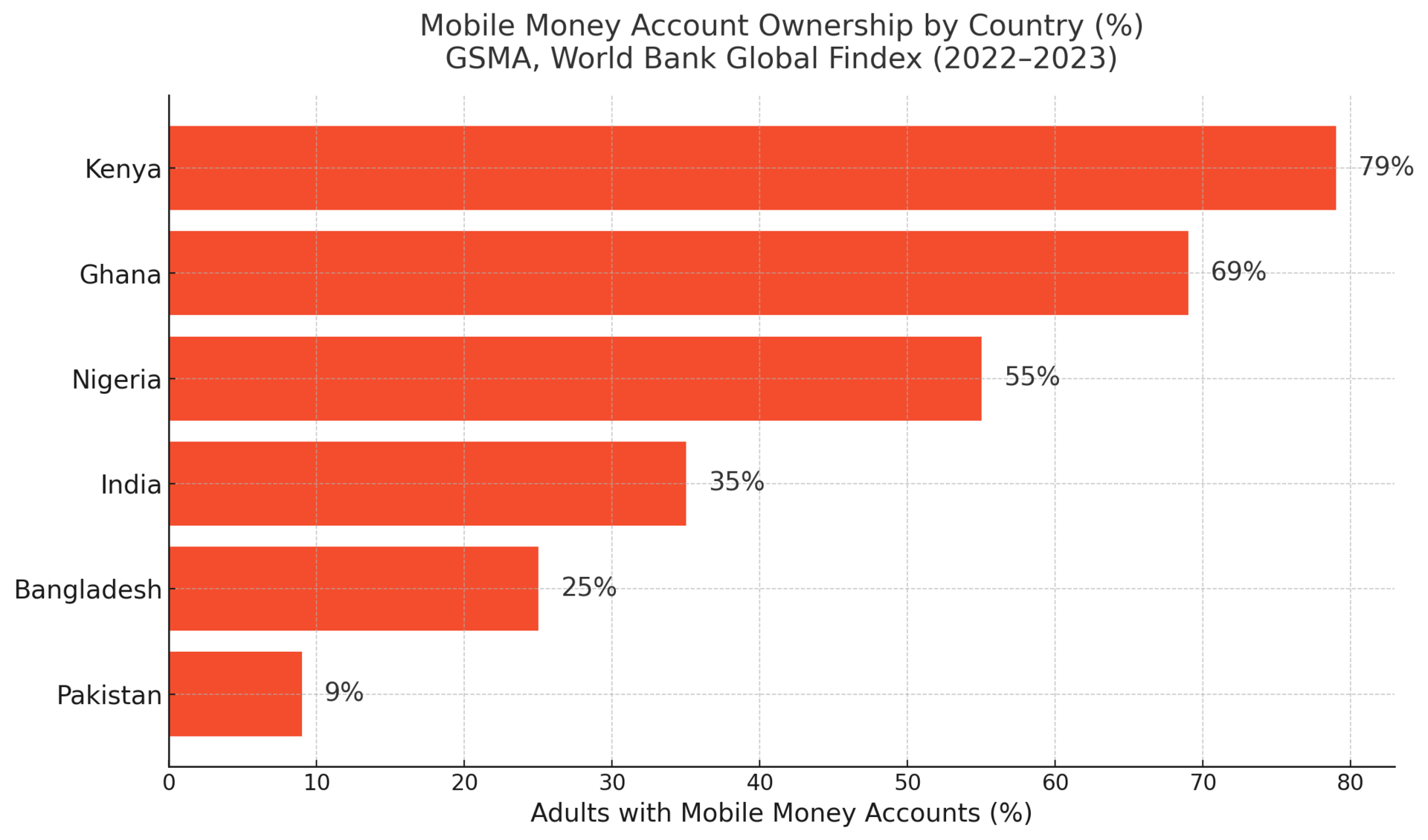

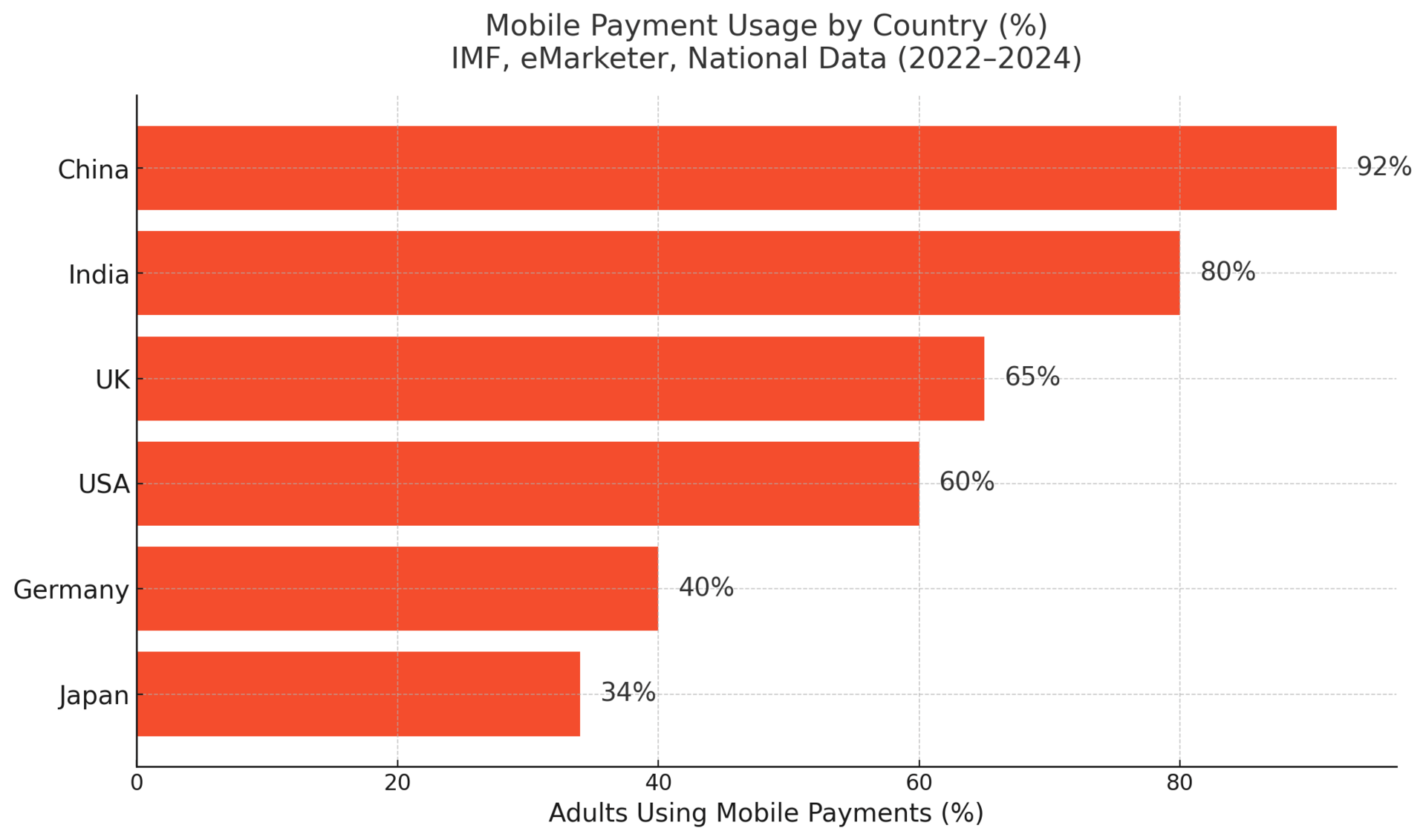

India’s journey to digital payments began with shock: the 2016 demonetization wiped out 86% of the country’s cash overnight. The result? A massive push toward digital platforms like UPI, which now handles over 11 billion transactions per month.

But it’s not all smooth. While cities like Bengaluru are nearly cashless, rural villages often lack stable internet or even smartphones. Yet, even basic phones now offer payment options via USSD and voice-based services.

🔍 Curious twist: Despite having over 300 million people without smartphones, India boasts more than 300 million active digital payment users.

In Africa’s largest economy, the shift to digital has been dramatic—and rocky. Nigeria launched the eNaira, Africa’s first central bank digital currency (CBDC), alongside a surge in mobile wallets like Opay.

But 2023’s cash crisis, triggered by a botched currency redesign, sparked long ATM queues and public unrest. Many questioned the government’s digital-first push amid failing infrastructure.

Despite this, younger Nigerians are fueling growth in fintech and crypto adoption, making the country one of Africa’s most digitally dynamic.

📉 Surprising insight: Over 60% of Nigerians still rely on the informal cash economy—despite soaring mobile money use.

Put Interest On Ice Until 2027

Pay no interest until 2027 with some of the best hand-picked credit cards this year. They are perfect for anyone looking to pay down their debt, and not add to it!

Click here to see what all of the hype is about.

In a country synonymous with innovation, Japan’s attachment to cash seems paradoxical. But it’s cultural—and deliberate.

Only about 30% of payments are digital. Many older citizens still prefer the tangible certainty of banknotes. Privacy concerns and disaster readiness (cash works during power outages) also play a big role.

However, programs like “Cashless Japan” are slowly shifting habits—especially among youth and tourists.

📦 Little-known fact: Many Japanese keep large sums of cash at home, both for emergencies and as a hedge against low bank interest.

No country has embraced digital payments like China. In cities, cash is practically obsolete. QR codes from Alipay and WeChat Pay dominate markets, taxis—even temple donations.

Layered on top is the digital yuan, giving the government deep visibility into financial activity. While critics raise privacy concerns, most citizens see convenience as worth the tradeoff.

📲 Provocative stat: By 2024, over 85% of Chinese citizens used a mobile wallet every single week.

Germany is modern, affluent—and surprisingly analog when it comes to money. About 59% of all payments are still made in cash. Privacy, autonomy, and mistrust of centralized financial surveillance drive this preference.

The COVID-19 pandemic increased contactless adoption, but many small businesses still refuse cards. “Cash is freedom,” say many Germans—and they mean it.

💶 Unexpected detail: German law allows anonymous cash payments for transactions up to €10,000—no ID required.

The U.S. is a mixed bag. In cities like San Francisco or New York, mobile and contactless payments are mainstream. But in many rural areas, cash is still king—and over 14 million Americans remain unbanked.

Federal law doesn’t require businesses to accept cash, so some cities have passed their own laws to protect low-income and older populations.

Meanwhile, apps like Apple Pay, Venmo, and Zelle are gaining momentum, especially among younger consumers.

💡 Interesting angle: The U.S. Treasury still prints billions in cash annually—even as digital transactions surpass them in value and volume.

The death of cash isn’t just a tech story—it’s a human one. For some, it means speed and simplicity. For others, it spells exclusion, surveillance, or risk.

Where each country stands can shape how—and where—you live, invest, or plan for the unexpected.

The future of money is coming fast. It won’t look the same everywhere. And it won’t wait.

Stay alert. Stay adaptable. And always keep a plan B in your pocket.

Warm regards,

Shane Fulmer

Founder, WorldPopulationReview.com

P.S. Want to sponsor this newsletter? Reach 140,000+ global-minded readers — click here!